- 1. Tickeron – AI Bots with Free Access and Paper Trading Support

- 2. Trade Ideas – Advanced AI Stock Scanner with Free Trial

- 3. StockHero – User-Friendly Bot Creator with Free Plan & Marketplace

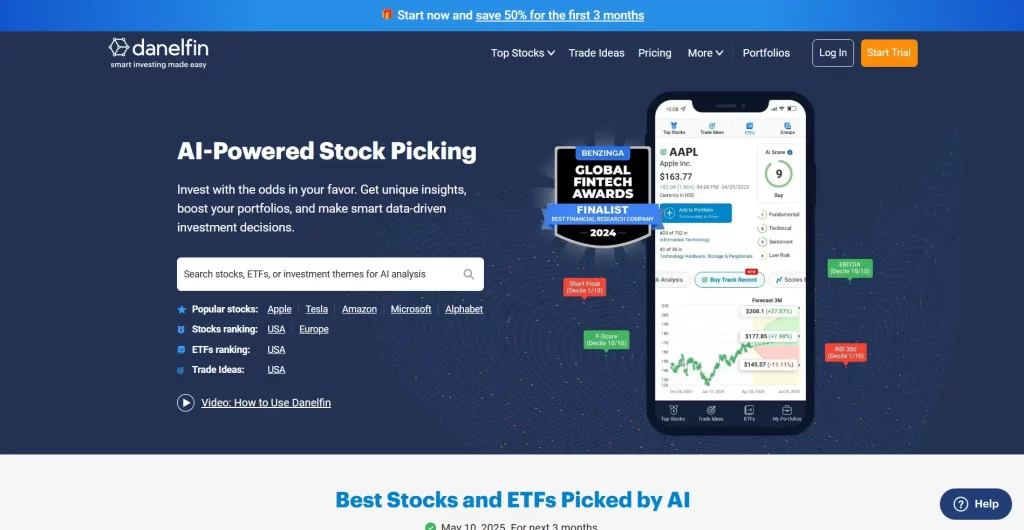

- 4. Danelfin – Free AI Stock Picker with Global Market Insights

- 5. Capitalise.ai – Code-Free Strategy Automation (Completely Free in 2025)

- Conclusion

The year 2025 has seen artificial intelligence transform the stock trading landscape. AI-powered trading bots are now mainstream tools, helping traders analyze markets and execute strategies faster and more objectively than ever. A recent global survey found that 75% of retail traders using AI-assisted analysis improved their trade accuracy by 50%. In fact, AI-driven systems accounted for 68% of trade flow on major stock exchanges in 2024. This surge in AI trading is enabling individual investors to tap into sophisticated techniques once reserved for Wall Street professionals. Between 2020 and 2024, the number of retail traders on AI-driven platforms rose by 120% as AI tools became more accessible. This highlights the importance of having access to AI stock trading bots for free.

For beginners, these advances are especially exciting. AI stock trading bots can help new traders overcome emotional biases, learn from data-driven insights, and even practice risk-free through simulations. Many newcomers search for an ai stock trading bot free of charge to try automated trading without a big financial commitment. The good news is that several platforms now offer free access (or free trial tiers) to powerful AI trading assistants. These services allow novices to experiment with algorithmic stock trading, often with paper trading modes to practice without risking real money. Below, we at 1Byte highlight the top 5 beginner-friendly platforms in 2025 that provide AI stock trading bots for free (or with free tiers/trials), along with their key features and benefits for new traders.

1. Tickeron – AI Bots with Free Access and Paper Trading Support

Tickeron is an established AI trading platform that offers a library of pre-built bots and predictive tools for stock and ETF trading. It caters to various trading styles – from day trading to swing trading – letting users choose AI strategies that match their preferences. Uniquely, Tickeron allows adjusting each bot’s “momentum reaction” sensitivity (from Slow to Fast), giving beginners fine control over how reactive the AI is to market moves. This means you can dial a bot’s aggressiveness up or down to suit your risk tolerance and time frame.

Crucially for newcomers, Tickeron provides a free basic plan. While advanced features require paid subscriptions (ranging ~$20–$125/month for premium tools), the free tier lets users explore Tickeron’s basic AI bots and signals in a low-risk setting. You can even use Tickeron’s integrated paper trading mode at no cost – simply register for a free account and start running the AI bots in a virtual portfolio to see how they perform without putting real money at stake. This combination of free access and simulation is ideal for learning. For example, a beginner could activate a trend-following bot on their paper account and observe how the AI generates entry/exit signals over time.

How It Helps Beginners

Tickeron’s ready-made AI bots and free paper trading environment lower the barrier to entry. New traders can experiment with different strategies (momentum, swing, etc.) and gain confidence by testing AI signals risk-free before going live. The platform’s AI-driven screeners and pattern recognition tools provide actionable insights that beginners might miss on their own. Overall, Tickeron offers an easy on-ramp into AI trading – you get a feel for algorithmic strategies and market analysis without spending a dime upfront.

Key Features

- Free Basic Plan & Bots: Core features are accessible with a free account; explore AI stock predictions and simple bots without subscription fees.

- AI for Multiple Styles: Suite of AI bots tailored to day trading, swing trading, trend trading, and more – choose strategies aligned with your goals.

- Paper Trading Simulator: Integrated virtual trading lets you backtest and paper trade AI strategies in real-time market conditions for free, perfect for practice.

- Customization Controls: Unique momentum sensitivity setting to adjust how quickly bots react to market changes, plus options to tweak risk management parameters.

- Education & Community: Tickeron includes an academy and community features (like shared “AI portfolios” and trade ideas) to help beginners learn from AI insights and from other users.

2. Trade Ideas – Advanced AI Stock Scanner with Free Trial

Trade Ideas is a veteran platform in the trading industry, known for its cutting-edge AI named “Holly.” Launched back in 2003, Trade Ideas was a pioneer in applying AI to stock scanning and strategy automation. Its AI subsystem Holly generates daily trade ideas – essentially buy/sell signals – by analyzing countless market patterns and optimizing strategies overnight. For a beginner, this is like having a tireless virtual analyst watching the market and alerting you to interesting setups each day.

While Trade Ideas is a subscription service (Standard and Premium plans cost roughly $89 to $178 per month), it offers a free trial and demo mode that new users can take advantage of. You can “give Trade Ideas a spin for free” to evaluate how well its AI picks perform. During the trial, beginners get access to features like the simulated trading environment and backtesting tool (OddsMaker). These tools allow you to paper trade the AI’s stock picks and test your own strategies on historical data. For example, you might run Holly’s recommended trades in the simulator for a week to see how they pan out, or backtest a strategy on last year’s data – all without any risk or cost.

Trade Ideas also supports live connectivity to brokerage accounts when you’re ready, so you can automate real trades based on the AI signals. For novices, though, the primary benefit is in analysis and education. The platform’s AI-driven scanners continuously monitor the market to flag high-probability setups, which can teach beginners what patterns and conditions often precede a profitable trade. Its charts and visualization (like the “Money Market Race” where stocks are visualized as racing horses) make learning interactive.

How It Helps Beginners

Trade Ideas serves as an AI mentor for new traders. By observing Holly’s daily picks and using the simulator, beginners learn which technical signals and market conditions the AI deems important. It’s a great way to discover trading opportunities you might overlook on your own. The free trial means you can access this advanced toolset at no initial cost, and the user-friendly interface (no coding required) lets you focus on learning market behavior. Just keep in mind that after the trial, full functionality requires a paid plan – but at least you’ll know whether the AI insights are worth it for your trading style.

Key Features

- AI Stock Picker “Holly”: Proprietary AI that generates trade signals and setups each day, acting as a virtual analyst scanning thousands of stocks.

- Simulated Trading & Backtesting: Includes OddsMaker for strategy backtesting and a realistic trading simulator, so you can refine strategies and practice with fake money.

- Real-Time Scanning Alerts: Constant market scanning for various strategies (gap plays, momentum, mean reversion, etc.), with customizable alerts to catch moves as they happen.

- Free Trial Available: Try the full platform at no cost for a limited period – access AI signals and all tools to evaluate usefulness for your needs.

- No Coding Needed: Point-and-click interface and English-like strategy building (you can set conditions in plain language), suitable for beginners who aren’t programmers. Trade Ideas integrates with popular brokers to automate trades once you gain confidence.

3. StockHero – User-Friendly Bot Creator with Free Plan & Marketplace

StockHero is a modern AI-assisted trading bot platform designed with beginners in mind. It provides a no-code environment where users can create, customize, and deploy stock trading bots without writing any code. For those just starting out, StockHero even offers a marketplace of pre-built bots – you can simply select a strategy developed by experienced traders/quantitative analysts and let it run. This means a newbie can literally get a bot trading in minutes by renting or using a free template strategy, rather than building one from scratch.

A standout aspect of StockHero is its generous free tier. The platform has multiple pricing plans, but it maintains a free version with basic features to allow newcomers to experiment at zero cost. On the free plan, you can create and test simple bots, perform backtests, and even engage in paper trading. In fact, StockHero’s paper trading environment simulates real market conditions, so beginners can practice and see how their bot would perform without risking capital. For example, you might configure a bot that buys S&P 500 stocks on dips and set it to paper trade over several weeks to gauge its win rate. If the results look good, you could then connect a brokerage account and switch to live trading on a paid tier – but that step is completely optional.

StockHero supports integration with major U.S. brokers like TradeStation, Webull, and E*Trade, enabling live execution when desired. It also provides handy risk management tools (stop-loss, take-profit settings, etc.) and notifications. For instance, you can set a bot to automatically sell a stock if it drops 5% or send you an alert if a trade is executed – features that help beginners manage risk while learning.

How It Helps Beginners

StockHero’s intuitive interface and pre-built strategies remove much of the complexity of algorithmic trading. A beginner can learn by doing: tweak parameters on a template bot, run backtests, and observe outcomes. The fact that you don’t need programming skills lowers the barrier significantly. The free plan is perfect for exploring: you get to try different trading algorithms and understand how changes in strategy affect performance, all without a financial commitment. Essentially, StockHero acts as a sandbox where new traders can safely experiment with AI-driven trading ideas and build confidence.

Key Features

- Free Tier (Basic Plan): Allows creation of basic bots, unlimited strategy backtesting, and use of the bot paper trading mode at no cost. You can truly experience an “ai stock trading bot free” with this plan.

- No-Code Bot Builder: Construct trading strategies via a visual interface. Choose indicators (moving averages, RSI, etc.), set buy/sell rules, and let the AI bot execute – all without coding a single line.

- Bot Marketplace: Library of pre-made bots contributed by experts. Beginners can pick a strategy (e.g. DCA bot, breakout bot) from the marketplace and deploy it instantly, learning from the bot’s logic and performance.

- Paper Trading & Backtesting: Simulated trading environment to test strategies in real-time or on historical data. This helps users validate ideas and learn how their bot would behave in different market scenarios.

- Risk Management Tools: Built-in options like stop-loss, take-profit, and fund allocation per bot to help beginners safeguard against large losses. StockHero emphasizes risk controls so you can learn discipline as you automate trades.

4. Danelfin – Free AI Stock Picker with Global Market Insights

Danelfin takes a slightly different approach to AI trading assistance: it’s an AI-driven stock analysis and picking service rather than an automated trade execution platform. Based in Barcelona, Spain (bringing some international flavor to our list), Danelfin has gained recognition for its AI stock ratings and predictions. The platform analyzes each stock through hundreds of indicators – 600+ technical factors, 150 fundamental metrics, and 150 sentiment variables every day to be exact – and boils this down into an easy-to-understand AI score (often 1 to 10) for the stock’s expected performance. It essentially tells you which stocks the AI believes have the best odds of beating the market.

For beginners, Danelfin can be incredibly valuable as a research aid. It helps answer the question “What should I trade?” by providing data-backed rankings and trade ideas. Users can create a portfolio of their favorite stocks and let Danelfin’s AI monitor and provide signals on them. Notably, Danelfin offers a Free plan (forever) with no credit card required. The free tier lets you track a portfolio of up to 5 stocks or ETFs, view AI scores and rankings for top stocks, and receive daily AI-driven stock ideas and alerts. This means a beginner can sign up for $0, input a few stocks they’re interested in (say Apple, Tesla, etc.), and get daily insights like: “Apple’s AI score is 9/10 (Buy) with an upgraded outlook” or “Tesla’s score dropped, consider risk.” These insights can guide your trading or investing decisions.

While Danelfin doesn’t execute trades for you, it provides the analysis and signals that you can use on any trading platform. You could, for example, use Danelfin’s top-rated stocks list to decide which stocks to include in a paper trading portfolio on another broker. In fact, Danelfin reports an impressive track record: their AI-guided portfolio allegedly returned 263% from 2017 to 2024, versus 189% for the S&P 500. This past performance (while not a guarantee of future results) indicates the AI’s potential to identify winners. Beginners can thus lean on Danelfin’s AI as a second opinion or idea generator to supplement their own research.

How It Helps Beginners

Danelfin essentially acts as an AI stock advisor. New traders who may not know how to dissect financial statements or technical charts can rely on the AI’s composite scores and alerts to make more informed choices. It’s like having a robo-analyst on call. The platform’s simple dashboard (with clear “Buy” or “Sell” signals, star rankings, etc.) is easy to understand. And because the basic version is free, beginners can use Danelfin as a learning tool indefinitely – observing how AI scores correlate with actual stock performance and news. This can accelerate the learning curve in understanding market drivers.

Key Features

- Free Plan with AI Ratings: $0 forever plan allows one portfolio with 5 stocks/ETFs. Get daily AI stock picks, top stock/ETF rankings, and basic alerts without any subscription fee.

- AI Score & Predictions: Each stock is assigned an AI Score (0-10). The AI analyzes technical trends, fundamentals, and sentiment to predict short-term performance. High scores highlight bullish opportunities.

- Global Market Coverage: Offers stock rankings for both USA and Europe markets, so international beginners can find picks in their local exchanges too. Also identifies top sectors and industries to focus on (e.g. “AI finds Technology or Healthcare stocks favorable now”).

- Track Record & Transparency: Danelfin often shares the performance of its AI-model portfolio (e.g. +263% in 7 years vs market +189%). It also explains its reasoning by showing contributing factors (like “Fundamental score 8/10, Technical 10/10” for a stock), helping users learn why a stock is rated well.

- Easy Export & Integration: While you trade elsewhere, you can export Danelfin’s ideas to implement in your strategy. For instance, use the “Top 10 AI stocks to buy” list to paper trade on your brokerage. Danelfin essentially augments your decision-making with AI intelligence, which is perfect for beginners building their first portfolios.

5. Capitalise.ai – Code-Free Strategy Automation (Completely Free in 2025)

Capitalise.ai is a unique platform that brings the power of automation to those who don’t know how to code algorithms. It’s not a traditional trading bot with preset strategies, but rather a natural-language strategy builder that turns your words into trading bots. Capitalise.ai allows a user to simply type out a trading rule in plain English, and it will execute that rule automatically in a connected brokerage account. For example, a beginner could write: “If Apple stock drops below $150, buy 10 shares. Then sell if it goes up 5%.” – and the platform will interpret and run this strategy continuously. This opens the door for beginners to create personalized “bots” or automated rules without needing programming or advanced technical skills.

One of the most attractive aspects of Capitalise.ai is that it is completely free to use (for now). As of 2025, anyone can sign up and link their brokerage account without paying any fees or subscriptions. This free access is available thanks to partnerships (some brokers like Interactive Brokers and Forex.com offer Capitalise.ai to clients as a value-add service). The company has stated that all features are free with no monthly charges – and they’ve promised to notify users well in advance if that policy changes. In practical terms, a beginner can register on Capitalise.ai, connect a demo trading account (or real account when comfortable), and start automating strategies right away at no cost.

Capitalise.ai supports both paper trading and live trading modes. You can test your plain-language strategies on historical data or in real-time using a simulated account to ensure they work as intended. For instance, you might simulate a strategy like “Short the S&P 500 futures if the Fed rate decision news indicates a hike, close after 1 day” to see how the AI handles news-based triggers. The platform can incorporate data like price movements, technical indicators, time-based conditions, and even some news events or TradingView alerts as triggers. Its flexibility and simplicity have made it a popular tool for beginners and even non-technical traders.

How It Helps Beginners

Capitalise.ai is like having a personal coder translating your ideas into action. It lowers the barrier to algorithmic trading to essentially zero – no fees, no coding, and an easy learning curve. Beginners can experiment by writing different strategy ideas in plain English and letting the system run them. This process helps new traders think systematically: you learn to clearly define entry and exit rules and consider edge cases (because you have to “tell” the bot exactly what to do). Additionally, because it’s free, there’s no harm in running multiple paper trade strategies to see which ones work. Over time, a beginner can identify a strategy that performs well and then switch it to live trading for real profits, all on the same platform.

Key Features

- Completely Free Automation: As of 2025, Capitalise.ai has no charges or subscription fees – users can create unlimited strategies and connect broker accounts at no cost. This free access makes it one of the most cost-effective ways to start with trading bots.

- Natural Language Strategy Builder: Unlike typical bots, you write your trading plan in English. For example: “Buy 1 BTC if Bitcoin crosses above $30,000 and RSI < 30, then sell when RSI > 50 or price > $35,000.” The platform parses this and executes it 24/7. This is perfect for beginners not familiar with coding or complex trading software.

- Paper Trading & Alerts: You can run strategies in simulation or receive alerts instead of real trades. This lets you safely test ideas. Capitalise.ai also provides notifications (email, mobile) when conditions are met or trades executed, keeping beginners in the loop on their bot’s actions.

- Supports Stocks and More: The platform can connect to multiple brokers and supports assets including stocks, ETFs, forex, and crypto (depending on broker). For stock traders, it works with brokers like Interactive Brokers, enabling automation in equity markets. You can automate anything from simple buy/sell rules to more complex multi-condition strategies on stocks.

- Educational Templates: For those unsure where to start, Capitalise.ai offers example strategy templates and a wizard-like interface. You might load a template for a common strategy (e.g., “Mean Reversion: Buy if stock drops X% in a day, sell after Y% bounce”) and customize the parameters. This helps beginners learn strategy formulation and see how to phrase conditions effectively.

Leverage 1Byte’s strong cloud computing expertise to boost your business in a big way

1Byte provides complete domain registration services that include dedicated support staff, educated customer care, reasonable costs, as well as a domain price search tool.

Elevate your online security with 1Byte's SSL Service. Unparalleled protection, seamless integration, and peace of mind for your digital journey.

No matter the cloud server package you pick, you can rely on 1Byte for dependability, privacy, security, and a stress-free experience that is essential for successful businesses.

Choosing us as your shared hosting provider allows you to get excellent value for your money while enjoying the same level of quality and functionality as more expensive options.

Through highly flexible programs, 1Byte's cutting-edge cloud hosting gives great solutions to small and medium-sized businesses faster, more securely, and at reduced costs.

Stay ahead of the competition with 1Byte's innovative WordPress hosting services. Our feature-rich plans and unmatched reliability ensure your website stands out and delivers an unforgettable user experience.

As an official AWS Partner, one of our primary responsibilities is to assist businesses in modernizing their operations and make the most of their journeys to the cloud with AWS.

Conclusion

AI stock trading bots have undoubtedly lowered the entry barriers to active trading in 2025. With free access to advanced AI tools, beginners can learn by doing – honing their strategies through paper trades and AI insights before committing real funds. The platforms discussed above each offer a unique approach, from fully automated bot marketplaces to AI-guided stock picking services, catering to different needs and comfort levels. Importantly, all provide a way to start for free, aligning with the principle of trying before buying in the world of trading tech.

As you explore these platforms, keep a few considerations in mind. First, leverage the paper trading and backtesting features heavily. Every platform listed (Tickeron, Trade Ideas, StockHero, Danelfin, Capitalise.ai) allows you to test strategies in a risk-free mode. Take advantage of this to iterate and learn from mistakes. For example, run your bot in simulation for several weeks and evaluate its performance. If the results are poor, tweak the strategy or try a different approach – this is how you build a robust trading plan.

In summary, 2025 is an excellent time to be a beginner in trading. The convergence of free AI technology and trading platforms means anyone can experiment with complex strategies that were once only accessible to hedge funds. Whether you start with an AI stock trading bot free on StockHero, follow Danelfin’s AI stock picks, or craft a custom rule on Capitalise.ai, you’ll be learning valuable skills for the long run. Approach it with curiosity and caution, and let these AI tools complement your trading journey as you progress from novice to proficient trader.