- What’s Driving Payment Trends Right Now

- How to Use This Trend List (Without Getting Overwhelmed)

- Payment Tools Summary Table

-

Tool-Led Payment Trends to Implement Next

- 1. Stripe Payments

- 2. Adyen

- 3. Checkout.com

- 4. Spreedly

- 5. Square

- 6. Shopify Payments

- 7. Shop Pay

- 8. PayPal Checkout

- 9. Apple Pay

- 10. Amazon Pay

- 11. Klarna

- 12. Affirm

- 13. GoCardless

- 14. Plaid

- 15. Trustly

- 16. Wise Platform

- 17. Airwallex

- 18. Visa Direct

- 19. Mastercard Send

- 20. Tipalti

- 21. Bill.com

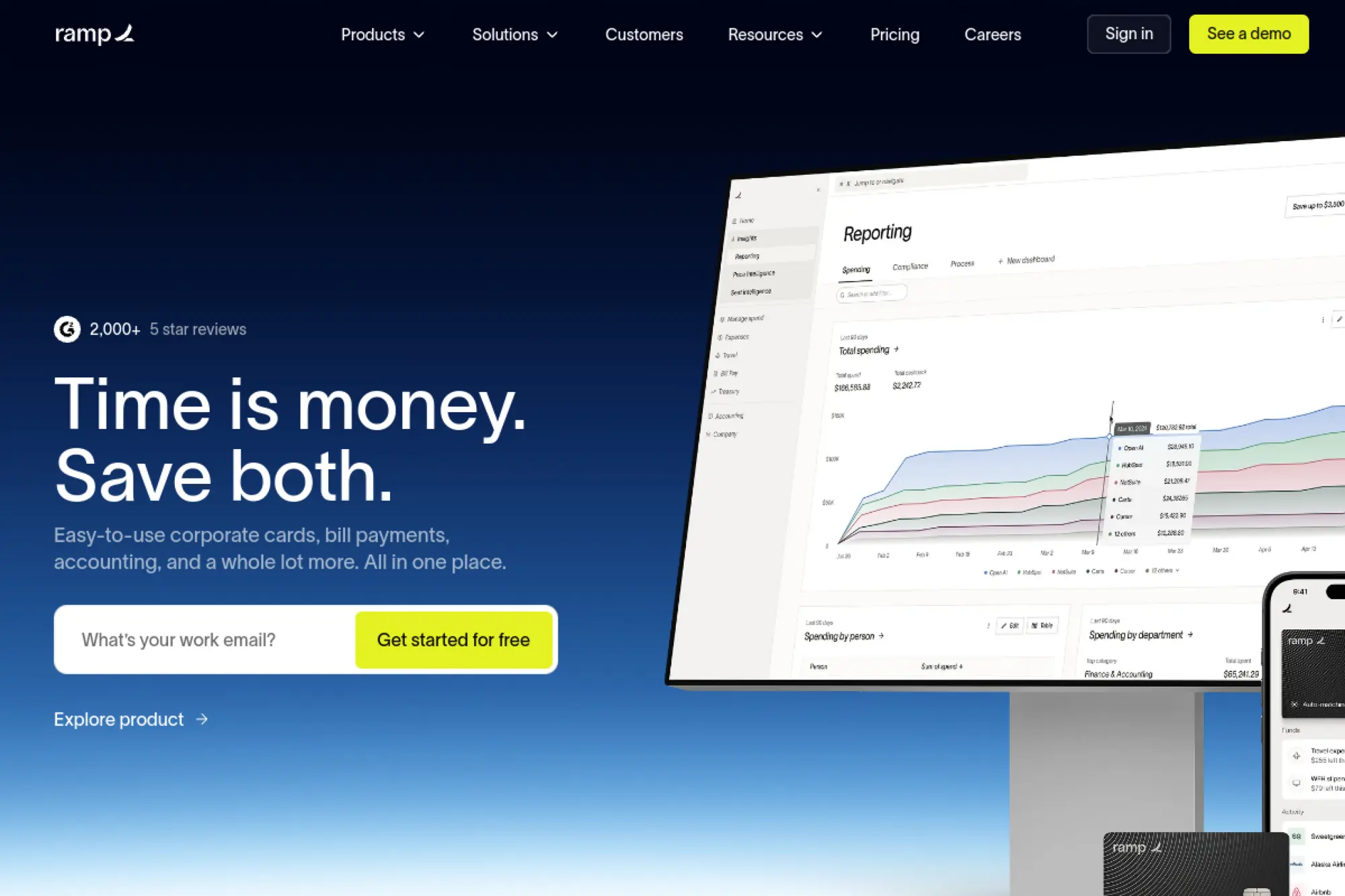

- 22. Ramp

- 23. Modern Treasury

- 24. Marqeta

- 25. Galileo

- 26. Persona

- 27. Forter

- 28. Riskified

- 29. Sift

- 30. Circle

- Conclusion

Payments now sit at the center of customer experience. A checkout flow can feel smooth, fast, and trustworthy. Or it can feel risky, confusing, and slow.

That is why payment trends deserve a spot on your growth roadmap, not just your finance checklist. The teams that treat payments like a product usually win more orders. They also reduce support tickets, prevent avoidable fraud, and reconcile faster.

This guide focuses on practical moves. You will see tools that businesses already use to ship modern payment experiences. Each section explains what the tool helps you do, what to configure first, and what to watch before you roll changes out to all customers.

You do not need to adopt every trend. You do need to understand which shifts affect your customers, your costs, and your risk. Then you can pick a small set of upgrades that compound over time.

What’s Driving Payment Trends Right Now

Payments scale keeps growing, and it changes who competes with you. The market is big enough that small conversion gains create real revenue. A recent industry snapshot describes a payments revenue pool $2.5 trillion in revenue from $2.0 quadrillion in value flows, supported by 3.6 trillion transactions worldwide that touches almost every business model.

Digital wallets now shape the default checkout experience for a large share of consumers. They reduce typing, improve security signals, and “bundle” identity with payment choice. Worldpay reports $13.9 trillion spent via digital wallets in 2023, accounting for 50% of e-commerce and 30% point-of-sale consumer spend, which helps explain why wallet buttons keep moving higher on checkout pages.

Cash does not disappear, but customer behavior keeps moving toward digital convenience. The Federal Reserve’s consumer diary found cash accounted for 14% of all consumer payments by number, while credit cards accounted for 35% of payments, and adults aged 18 to 24 used their phones for 45% of all payments, which reinforces a simple point: your checkout must work beautifully on a phone.

Meanwhile, fraud shifts from “rare edge case” to “daily operational reality.” Scams, account takeovers, and refund abuse hit customer trust, not just your margins. At the same time, regulators raise expectations for customer authentication, consumer rights, and data use. These forces push teams to modernize identity, risk, and reconciliation workflows together, not in silos.

Put differently, the biggest driver is not one new payment method. The driver is a new baseline: customers expect speed, clarity, and safety every time they pay. When you meet that baseline, you earn repeat purchases. When you miss it, customers abandon the cart and do not come back.

How to Use This Trend List (Without Getting Overwhelmed)

Most payment teams get stuck because “payments” sounds like one big project. It is not. Payments break down into small decisions across checkout, payouts, billing, fraud, and finance operations.

Start by picking the customer moment you need to improve. For many businesses, that moment is checkout conversion on mobile. For others, it is faster payouts to sellers, creators, or contractors. Sometimes it is simply getting a clean reconciliation process so finance can close faster.

Next, decide what you will measure. Focus on a few signals that match your goal. For checkout, watch completion rates, authorization success, and refund friction. For payouts, watch delivery speed, support contacts, and partner retention. For fraud, watch chargebacks, manual review load, and false declines.

Then, choose tools that fit your current architecture. If you already run a commerce platform, prioritize native options before custom builds. If you operate across regions, consider orchestration so you can avoid lock-in and reduce downtime risk. If you sell subscriptions, treat billing recovery as a core growth lever, not a back-office task.

Finally, ship in small increments. Payments changes can affect revenue instantly, so you want controlled rollouts. Use staged launches, clear fallback paths, and tight monitoring. A small improvement that stays stable beats a big change that breaks on a busy day.

Payment Tools Summary Table

Here’s a skimmable table to summarize each tool that stays ahead of the top payment trends and what it’s best for. Read on to find out more details for each pick.

| Tool | Primary Category | Best For | Payment Trend | Typical Use Cases |

|---|---|---|---|---|

| Stripe Payments | Payment processing (API-first) | Fast implementation and extensible payments stack | Modular, API-first payments stacks | Checkout, payments APIs, developer-led integrations |

| Adyen | Enterprise PSP | Brands that need one platform across channels | Unified commerce across in-store and online | Omnichannel payments, consolidated reporting, enterprise scale |

| Checkout.com | Global acquiring | Businesses optimizing global payment performance | Cross-border performance optimization | Improving authorization rates, local method expansion, global scaling |

| Spreedly | Payment orchestration | Teams that want routing and provider flexibility | Orchestration for resilience and reduced lock-in | Multi-PSP routing, tokenization, failover, payments abstraction |

| Square | POS + commerce | SMBs selling in-person with simple online tie-ins | Software-first POS and lightweight omnichannel | POS, invoicing, simple online checkout, retail operations |

| Shopify Payments | Commerce-native payments | Shopify merchants who want minimal setup | Platform-native payments inside the admin | Checkout enablement, unified payouts, simpler operations |

| Shop Pay | Accelerated checkout | Merchants focused on mobile conversion | Accelerated checkout with saved details | One-tap checkout, faster mobile purchase flows |

| PayPal Checkout | Digital wallet | Merchants who benefit from wallet trust signals | Wallet-based checkout to reduce typing friction | Wallet payments, faster checkout for returning PayPal users |

| Apple Pay | Device wallet | Mobile-first checkout experiences | Wallet-first mobile checkout with device auth | One-tap mobile payments, biometric authentication |

| Amazon Pay | Account-based checkout | Brands that want “stored identity” checkout | Account-based checkout with stored credentials | Address + payment reuse, faster checkout for Amazon users |

| Klarna | BNPL | Merchants improving conversion for higher-AOV carts | BNPL evolving into a demand channel | Pay over time, checkout financing, shopper acquisition surfaces |

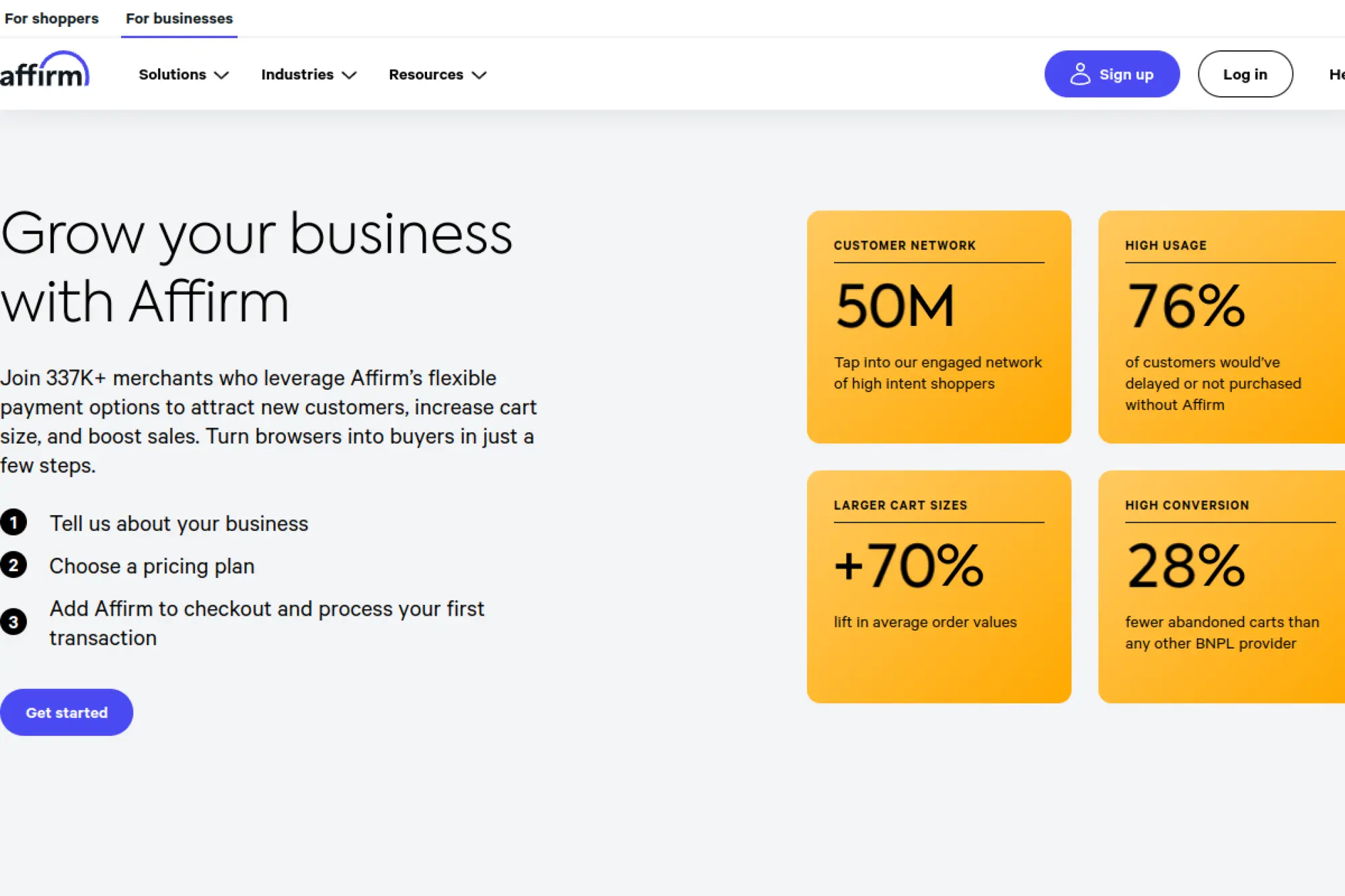

| Affirm | BNPL | Merchants selling higher-ticket items | Embedded financing at checkout | Installments, pay-over-time offers, conversion lift for big purchases |

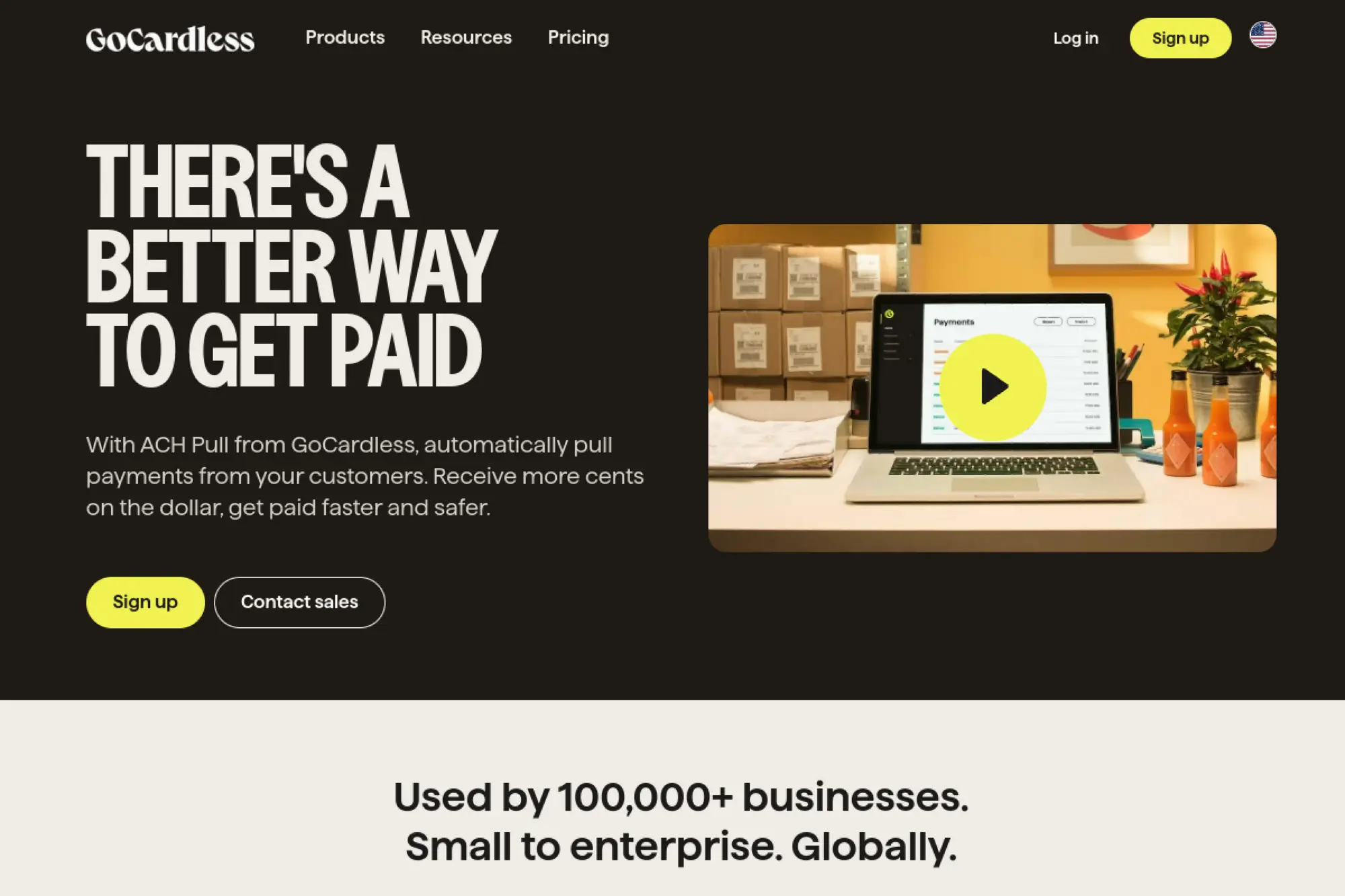

| GoCardless | Bank debit (recurring) | Subscription billing that needs lower churn | Bank-based recurring payments vs. card churn | Direct debit collections, recurring billing stability |

| Plaid | Open banking | Bank-verified onboarding and account connections | Open banking becoming a payment channel | Account verification, bank linking UX, bank-connected flows |

| Trustly | Pay-by-bank | Merchants reducing card costs and failures | Pay-by-bank checkout as a card alternative | Account-to-account payments, bank login-based checkout |

| Wise Platform | Cross-border payouts | Businesses paying users or partners internationally | Cross-border payouts as a product experience | International disbursements, transparent delivery status, FX handling |

| Airwallex | Multi-currency money movement | Companies operating across markets and currencies | Collect/hold/pay globally with fewer seams | Multi-currency accounts, cross-border payouts, global collections |

| Visa Direct | Instant payouts (push-to-card) | Platforms that need fast disbursements to users | Instant payouts becoming table stakes | Gig payouts, marketplace seller payouts, refunds, claims, incentives |

| Mastercard Send | Instant payouts | Businesses expanding payout delivery options | More flexible payout endpoints and coverage | Disbursements, recipient payments, payout operations at scale |

| Tipalti | Payables automation | High-volume payee onboarding and compliance workflows | Payout ops as a brand experience | Mass payouts, payee onboarding, tax/compliance flows, approvals |

| Bill.com | AP/AR automation | SMB and mid-market finance teams modernizing back office | Business payments moving from manual to automated | Invoice workflows, approvals, vendor payments, receivables |

| Ramp | Spend management | Teams controlling spend with real-time policy | Spend controls converging with payments | Corporate cards, expense automation, policy enforcement |

| Modern Treasury | Payment operations | Businesses needing better visibility and reconciliation | Ops-first orchestration and reconciliation | Bank payment flows, status tracking, reconciliation tooling |

| Marqeta | Card issuing | Products launching branded card experiences | Embedded finance through issuing and controls | Virtual/physical cards, real-time auth logic, spend controls |

| Galileo | Fintech infrastructure APIs | Brands building banking-like payment features | Infrastructure APIs accelerating fintech builds | Accounts/cards infrastructure, programmatic money movement features |

| Persona | Identity verification | Risk-based onboarding for regulated or fraud-sensitive flows | Identity as a core payments performance layer | KYC/KYB-style verification, onboarding checks, step-up verification |

| Forter | Fraud decisioning | Merchants protecting revenue without hurting conversion | Frictionless fraud prevention (reduce false declines) | Fraud scoring, checkout risk decisions, conversion-friendly controls |

| Riskified | Fraud + chargeback outcomes | Merchants wanting more predictable fraud ops | More structured fraud outcomes and less manual review | Chargeback management, risk policies, fraud operations scaling |

| Sift | Account protection + abuse | Marketplaces and apps fighting ATO and abuse | Behavioral risk signals across the funnel | Account takeover prevention, promo abuse detection, risk monitoring |

| Circle | Stablecoin infrastructure | Teams exploring faster settlement and programmable rails | Stablecoins moving toward mainstream settlement rails | Stablecoin payments, cross-border settlement, programmable money flows |

Tool-Led Payment Trends to Implement Next

1. Stripe Payments

Many teams now want a modular payments stack that lets them ship quickly. Stripe fits this trend because it gives product and engineering teams building blocks for checkout, recurring billing, and money movement. You can start simple, then add complexity as your business grows.

Payment trend

Modular, API-first payments stacks that let teams add checkout, billing, and money movement in building blocks.

Best for

Online-first businesses that need flexible checkout, subscriptions, or marketplace-style flows.

Key workflows to configure

- Define your payment method strategy by country and device type.

- Set up webhooks so your order system stays in sync with payment events.

- Build clean refund and partial refund paths in your support tools.

- Design a clear decline handling flow that keeps customers moving.

Sales growth lever

Use Stripe to reduce checkout friction and test changes faster. Faster iteration helps you improve conversion without redesigning your whole storefront. You also gain room to add new payment methods when customers ask for them.

Watch outs

Payments become easy to launch and easy to sprawl. Keep strong ownership so product, finance, and support stay aligned. Also plan how you will handle disputes, refunds, and edge-case failures before you scale volume.

Quick start checklist

- Map your current payment and refund journey end to end.

- Implement a hosted or prebuilt checkout to ship faster.

- Connect webhooks to your order and fulfillment logic.

- Run real device testing for mobile checkout flows.

- Set dashboards for success rates, declines, and refunds.

2. Adyen

Unified commerce keeps gaining momentum. Customers expect the same payment experience across store, web, and app. Adyen supports this trend with a single platform that can connect in-person and online payments, which helps you see customer behavior across channels.

Payment trend

Unified commerce (one payments layer across in-store, web, and app) with consistent customer and reporting data.

Best for

Retailers and hospitality brands that operate both in-person and online channels.

Key workflows to configure

- Align in-store and online payment data fields for consistent reporting.

- Configure unified tokenization so returning customers check out faster.

- Build seamless returns and exchanges across channels.

- Set up centralized permissions for store staff and finance teams.

Sales growth lever

When you connect channels, you reduce “dead ends.” Customers can buy online and return in-store without friction. Staff can also help customers complete payments faster, which reduces abandoned purchases.

Watch outs

Unified commerce needs operational discipline. If stores use inconsistent SKUs, tax rules, or refund processes, reporting becomes noisy. Plan for training and clear playbooks, not just an integration.

Quick start checklist

- Standardize product and order identifiers across systems.

- Launch a pilot in a small set of locations first.

- Test returns, exchanges, and offline edge cases.

- Train store teams on the new payment and refund flow.

- Review reporting with finance before full rollout.

3. Checkout.com

Global selling pushes businesses to care about authorization performance and local payment expectations. Checkout.com aligns with this trend by focusing on international acceptance, local payment coverage, and performance optimization that can lift revenue without changing your product catalog.

Payment trend

Cross-border performance optimization (local methods + better authorization rates) to protect revenue globally.

Best for

Brands and platforms that sell across multiple countries and need strong cross-border performance.

Key workflows to configure

- Enable the payment methods your top markets prefer.

- Set currency presentation rules that match customer expectations.

- Build clear retry logic for soft declines and network failures.

- Standardize reconciliation exports for your finance workflow.

Sales growth lever

Improved authorization rates often create “found revenue.” You keep more legitimate transactions that would otherwise fail. You also reduce customer frustration caused by repeated declines or confusing payment screens.

Watch outs

International expansion adds complexity fast. Refund and chargeback rules vary by region. Make sure support teams understand how each payment method behaves, especially around disputes and settlement timing.

Quick start checklist

- Rank markets by revenue and failed payment volume.

- Add the top local payment methods for those markets.

- Verify your decline messaging and fallback methods.

- Confirm refund policies for each region.

- Monitor auth rates and customer complaints weekly.

4. Spreedly

Payment orchestration is a key trend for teams that want resilience and negotiating power. Spreedly supports this by letting you connect to many processors and gateways while keeping payment data portable. This helps you avoid a single point of failure and run experiments without re-platforming.

Payment trend

Payment orchestration for resilience, routing, and reduced provider lock-in.

Best for

Enterprises that need multi-provider redundancy, complex routing, or faster expansion into new markets.

Key workflows to configure

- Vault and tokenize payment methods so you can route them safely.

- Connect multiple gateways and define routing rules by region or brand.

- Set failover behavior for downtime and degraded performance.

- Build reporting that compares processor performance over time.

Sales growth lever

Orchestration helps you recover revenue that fails for avoidable reasons. You can route transactions to the best-performing provider. You also reduce downtime risk, which protects conversion during peak demand.

Watch outs

Orchestration does not remove the need for good contracts and support with each provider. It also adds a new layer to debug. Keep logging and clear ownership so teams can resolve incidents quickly.

Quick start checklist

- List every payment provider, method, and region you support.

- Decide your primary and backup processing paths.

- Implement vaulting before you migrate large volumes.

- Run parallel processing during the transition.

- Create dashboards for routing outcomes and failures.

5. Square

Point-of-sale keeps shifting from hardware-first to software-first. Square is great for this trend by bundling payments, POS, and business tools in a way that small teams can deploy quickly. It also helps unify in-person sales with online payments and invoicing.

Payment trend

Software-first POS and lightweight omnichannel selling for small and mid-sized operators.

Small and mid-sized sellers that want a fast setup for in-person payments and simple commerce operations.

Key workflows to configure

- Build your product catalog with clean categories and modifiers.

- Set up taxes, discounts, and receipt settings to match your brand.

- Connect online ordering or invoices to the same product data.

- Train staff on refunds, tips, and edge-case scenarios.

Sales growth lever

Shorter lines and faster payments directly protect revenue. Square also helps you sell in more places, such as events, pop-ups, and online links. That flexibility lets you capture demand when it spikes.

Watch outs

As you grow, you may want more customization than an all-in-one system offers. Also review how you will export data for accounting. Clean data early prevents messy reconciliation later.

Quick start checklist

- Set up items, categories, and employee permissions.

- Test a full transaction, refund, and receipt flow.

- Connect deposits to your accounting process.

- Document how staff should handle disputed charges.

- Review weekly reports for anomalies and trends.

6. Shopify Payments

Commerce platforms increasingly “own” payments. This trend matters because it reduces integration work and keeps operations in one admin. Shopify Payments supports this by offering a native way to accept payments, manage payouts, and handle disputes inside the Shopify workflow.

Payment trend

Platform-native payments (payments “owned” inside the commerce admin to reduce integration overhead).

Best for

Merchants that run on Shopify and want a streamlined payments setup with less technical overhead.

Key workflows to configure

- Complete business verification so payouts stay stable.

- Configure fraud analysis settings that match your risk tolerance.

- Set refund policies that align with your support scripts.

- Align order status triggers with fulfillment and capture timing.

Sales growth lever

Native payments reduce friction for your team, which helps you ship faster storefront changes. You also simplify customer support because orders, payments, and refunds live in one place. That clarity can improve customer trust after purchase.

Watch outs

Platform-native payments increase platform dependency. Review restrictions and acceptable-use rules before you build critical flows around them. Also plan a backup approach for business continuity.

Quick start checklist

- Verify your business details and bank payout settings.

- Test checkout, refund, and partial refund scenarios.

- Enable the payment methods your customers request most often.

- Set up dispute alerts and ownership for responses.

- Review reconciliation exports with finance.

7. Shop Pay

Accelerated checkout keeps moving from “nice to have” to “expected.” Shop Pay supports this trend by letting shoppers check out with saved information inside the Shopify ecosystem. It also supports checkout links that work well in social, email, and messaging channels.

Payment trend

Accelerated checkout (fast mobile conversion with saved details and off-site checkout links).

Best for

Shopify merchants that want a faster mobile checkout experience and stronger repeat purchase behavior.

Key workflows to configure

- Enable Shop Pay and confirm your shipping and tax settings.

- Validate how discounts behave with accelerated checkout buttons.

- Use checkout links for campaigns that start off-site.

- Confirm your analytics captures attribution across channels.

Sales growth lever

Faster checkout reduces abandonment, especially on mobile. Shop Pay also helps you meet customers where they already browse and buy. That can lift conversion from social and email without changing your product.

Watch outs

Accelerated checkout can bypass parts of your normal funnel. That can affect upsells, subscriptions, or discount logic. Test end-to-end before you launch widely so you do not surprise customers or your finance team.

Quick start checklist

- Turn on Shop Pay and run live transaction testing.

- Verify discount, shipping, and returns behavior.

- Create a set of campaign checkout links and track results.

- Train support on Shop Pay-specific questions.

- Monitor abandonment and refund reasons after launch.

8. PayPal Checkout

Wallet-based checkout remains a core trend because it adds trust and reduces typing. PayPal Checkout is a great representation of this trend, letting customers pay with a familiar wallet experience while you still control the rest of your storefront. It can also help first-time buyers feel safe buying from a brand they do not know well.

Payment trend

Wallet-based checkout that increases trust and reduces typing friction.

Best for

E-commerce brands that want to increase trust and capture wallet-preferring customers.

Key workflows to configure

- Add PayPal as a checkout option in the right funnel locations.

- Set webhooks or order updates so payment status stays accurate.

- Define how you will handle refunds and partial refunds.

- Align dispute workflows with your support and operations teams.

Sales growth lever

PayPal can improve conversion for customers who do not want to enter card details. It also supports faster repeat purchases because customers can reuse saved wallet information. That reduces friction at a key moment in the buying journey.

Watch outs

Wallet checkouts can change how customers perceive your brand experience. Make sure the flow still feels consistent and clear. Also prepare a dispute and escalation plan so your team responds quickly when issues arise.

Quick start checklist

- Enable PayPal in a staging environment and run end-to-end tests.

- Validate refund timing and customer notifications.

- Train support to recognize PayPal-related order states.

- Confirm reconciliation mapping for finance.

- Launch gradually and monitor conversion impact.

9. Apple Pay

Wallet-first checkout is now a baseline for mobile commerce. Apple Pay is a main player for this trend by reducing manual entry and using device-based authentication. It helps create a smooth checkout experience in apps and on the web when customers browse on Apple devices.

Payment trend

Wallet-first mobile checkout with device-based authentication and lower form friction.

Best for

Mobile-first stores and apps with repeat purchases, fast reorders, or impulse-friendly products.

Key workflows to configure

- Enable Apple Pay through your payment service provider.

- Set up domain verification and merchant identity configuration.

- Handle shipping updates and address changes cleanly.

- Support refunds in a way that matches your order system states.

Sales growth lever

Apple Pay reduces friction at the moment of purchase. That matters most on mobile where typing feels slow. A smoother flow often leads to fewer abandoned carts and fewer support tickets about failed payments.

Watch outs

Not every customer uses an Apple device. Always include a clean fallback checkout path. Also test edge cases like address changes, shipping restrictions, and digital goods.

Quick start checklist

- Confirm your provider supports Apple Pay in your target markets.

- Test on real devices across browsers and app versions.

- Review your address and shipping validation rules.

- Update customer support macros for wallet payments.

- Monitor payment failure reasons after release.

10. Amazon Pay

Account-based checkout is a growing trend because it reduces login friction and speeds up address entry. Amazon Pay supports this by letting customers use their Amazon account to pay and ship. For brands, it can act as a trust layer for first-time buyers.

Payment trend

Account-based checkout (stored identity, address, and payment credentials to reduce login/entry friction).

Best for

Brands with many first-time buyers who hesitate to create accounts or enter payment details.

Key workflows to configure

- Add Amazon Pay to checkout and align it with your order flow.

- Confirm tax and shipping calculations work with Amazon-provided addresses.

- Set up refund handling that updates both your system and the payment status.

- Train support to recognize Amazon Pay order scenarios.

Sales growth lever

Amazon Pay can reduce customer friction at checkout. It can also improve trust for shoppers who already use Amazon often. That trust can convert customers who would otherwise leave the cart.

Watch outs

Customers may associate Amazon Pay with Amazon’s broader ecosystem. Make sure your messaging stays clear about who sells and supports the product. Also watch data and privacy expectations.

Quick start checklist

- Implement Amazon Pay in a controlled pilot.

- Test address, shipping, and tax edge cases.

- Verify refund status updates across systems.

- Confirm analytics tracking and attribution.

- Expand gradually after support proves stable.

11. Klarna

Buy-now-pay-later keeps evolving from a payment option into a demand channel. Klarna supports demand by offering flexible payment options and marketing surfaces that can help customers discover products. For many categories, the payment choice also influences basket size.

Payment trend

BNPL evolving into a demand channel (payment flexibility plus discovery/marketing surfaces).

Best for

Consumer brands with higher-priced items, seasonal shopping spikes, or customers who value budget flexibility.

Key workflows to configure

- Place BNPL messaging where customers make purchase decisions.

- Integrate Klarna at checkout with clear eligibility messaging.

- Build clean refunds and returns workflows tied to order events.

- Align customer support scripts with Klarna-specific questions.

Sales growth lever

BNPL can raise conversion by easing upfront cost concerns. It can also increase average order value when customers feel more comfortable adding items. When you combine payments with discovery, you also unlock a new acquisition angle.

Watch outs

Returns can become more complex because customers may not understand how refunds map to installment plans. Keep policies simple and communicate clearly. Also monitor fraud and refund abuse trends closely.

Quick start checklist

- Decide where BNPL fits in your pricing and brand positioning.

- Implement Klarna and test partial refunds and returns.

- Update FAQs and support macros for installment questions.

- Track conversion and return rate changes after launch.

- Review fraud signals and adjust risk rules as needed.

12. Affirm

Financing at checkout is a durable trend, especially for higher-ticket categories. Affirm supports this payment trend by helping merchants offer payment flexibility while keeping the experience embedded in the checkout flow. For many brands, the real win is selling premium products without forcing customers into a large upfront payment.

Payment trend

Embedded financing at checkout to support higher-ticket conversion and bigger baskets.

Best for

Merchants selling big-ticket products or services where customers benefit from predictable payment plans.

Key workflows to configure

- Place financing messaging on product and cart pages.

- Integrate Affirm as a checkout option with clear terms messaging.

- Design refund workflows that handle partial and full returns cleanly.

- Align customer support and disputes handling with your payment policies.

Sales growth lever

Affirm can reduce purchase hesitation and help customers upgrade to higher-value items. It also helps you compete when customers compare similar products across multiple brands. A smoother financing option can be a deciding factor.

Watch outs

Financing can attract customers with different risk profiles and return behaviors. Watch your fraud, return, and support metrics after launch. Also ensure your marketing claims stay compliant and consistent.

Quick start checklist

- Choose the products and categories where financing makes sense.

- Integrate Affirm and test checkout and refund flows.

- Update product pages with clear, compliant messaging.

- Train support to answer financing-related questions confidently.

- Measure conversion lift versus added operational load.

13. GoCardless

Card churn and failed renewals push many subscription businesses to diversify payment rails. GoCardless enables you to move toward bank-based recurring payments. It helps you collect subscription fees through bank debit, which can reduce involuntary churn and improve long-term retention.

Payment trend

Bank-based recurring payments to reduce card churn and involuntary subscription churn.

Best for

Subscription businesses, membership programs, and B2B services that invoice recurring customers.

Key workflows to configure

- Set up mandate capture so customers authorize recurring debits.

- Automate payment collection schedules aligned to your billing cycle.

- Create a clear dunning flow for failed payments and retries.

- Sync payment status to your CRM or subscription management system.

Sales growth lever

Better collection stability improves retention without new marketing spend. Bank-based payments can also appeal to customers who prefer not to use cards. That flexibility can reduce cancellations and missed renewals.

Watch outs

Customer education matters. Some buyers understand cards better than bank debit. Make the value clear and keep the setup steps simple to avoid sign-up drop-off.

Quick start checklist

- Identify where card failures drive churn today.

- Add bank debit as an option during signup or billing updates.

- Build notifications for upcoming debits and failed collections.

- Align refunds and cancellations with bank debit behavior.

- Monitor churn and recovery rates after rollout.

14. Plaid

Open banking is shifting from a “data plumbing” layer into a real growth lever for onboarding and payments. Plaid helps businesses connect customer bank accounts securely, verify ownership and details with less friction, and support bank-based money movement where it fits, so teams can reduce manual entry, lower risk, and make bank-connected flows feel mainstream.

Payment trend

Open banking becoming a real payment channel (bank-verified onboarding, account verification, and bank-connected flows).

Best for

Fintechs and digital businesses that want faster bank-verified onboarding, account verification, and bank-based payments without building fragile bank integrations themselves.

Key workflows to configure

Use Plaid Link to streamline bank connection and remove manual routing/account entry.

Implement instant account verification signals to cut onboarding friction and reduce account-related fraud.

Design consent, copy, and step-by-step UX so customers understand what they’re approving and why.

Build fallbacks for edge cases (unsupported banks, connection failures, users who prefer not to log in), so conversion doesn’t collapse on exceptions.

Sales growth lever

Bank-verified flows can improve completion rates in signup and payment setup by reducing form friction and failed verification. When you trust the bank connection and automate the validation layer, you can onboard more legitimate users faster and spend less time on manual review and support.

Watch outs

Bank-linking can feel sensitive to users, especially if messaging is vague. Make the value clear, keep permissions minimal, and prepare support for common connection issues. Also plan for operational realities: bank-based payments and verification can behave differently than cards (timing, returns, and reconciliation), so your finance and ops workflows need to be ready.

Quick start checklist

Choose the primary use case (verification, onboarding signals, bank payments, or a phased rollout).

Implement a clean Link flow with clear consent messaging and brand-consistent UI.

Add fallbacks for failures and user drop-off (manual entry, alternate verification paths, retries).

Wire up event handling and reconciliation so product, support, and finance stay aligned.

Pilot with a defined segment, then iterate using completion, fraud, and support metrics before scaling.

15. Trustly

Pay-by-bank is one of the most important payment trends for businesses that want lower costs and fewer card-related failures. Trustly supports this by enabling direct bank payments in a checkout flow that feels familiar. It can also reduce fraud because customers authenticate with their bank.

Payment trend

Pay-by-bank checkout as a lower-cost alternative to cards with fewer card-related failures.

Best for

Businesses that want an alternative to card payments, especially for high-value or repeat transactions.

Key workflows to configure

- Add pay-by-bank as a clear option at checkout.

- Optimize the bank selection and authentication experience.

- Set up instant refund workflows when your use case needs them.

- Align reconciliation to bank settlement reporting and order data.

Sales growth lever

Pay-by-bank can convert customers who do not want to use cards. It can also reduce declines caused by card limits, expired cards, or issuer suspicion. That helps you keep revenue you already earned.

Watch outs

Customer education still matters in markets where pay-by-bank is newer. Use clear copy and simple prompts. Also ensure support teams understand how bank payments differ from cards when customers ask about timing and refunds.

Quick start checklist

- Launch pay-by-bank for a specific segment or checkout flow first.

- Test the full refund and customer notification journey.

- Update your checkout FAQ and support macros.

- Confirm reconciliation mapping for finance.

- Measure conversion and dispute outcomes versus cards.

16. Wise Platform

Cross-border payments keep becoming a product experience, not just a finance function. Wise Platform can help businesses pay international contractors, sellers, and partners through a streamlined payout workflow. It also helps reduce friction around currency conversion and delivery status.

Payment trend

Cross-border payouts as a product experience (clear delivery status, smoother FX, better partner experience).

Best for

Platforms and businesses that pay people or suppliers across multiple countries and currencies.

Key workflows to configure

- Collect recipient payout details in a structured, reusable format.

- Automate FX conversion rules so treasury stays predictable.

- Track payout status and surface updates in your support tools.

- Align payout confirmations with your internal ledger and reporting.

Sales growth lever

Faster, clearer payouts improve partner satisfaction. That can increase retention for sellers and creators. It can also expand your ability to recruit supply in new markets, which supports growth.

Watch outs

Cross-border payouts involve compliance, verification, and local banking quirks. Build a strong onboarding checklist for payees. Also set clear expectations about timing, especially around holidays and local bank schedules.

Quick start checklist

- Map your top payout corridors and currencies.

- Define payout approval workflows for finance.

- Integrate payout status updates into support tooling.

- Test payouts end-to-end with real recipients in pilot mode.

- Review FX exposure and treasury controls regularly.

17. Airwallex

Many global businesses now want a single way to collect, hold, and move money across currencies. Airwallex is that “single way”, supporting multi-currency accounts, international payouts, and tools that can reduce the operational friction of expanding globally.

Payment trend

Multi-currency money movement (collect, hold, and pay globally with fewer operational seams).

Best for

Businesses that need multi-currency collection and payouts, especially when they operate across several regions.

Key workflows to configure

- Set up local collection accounts for the currencies you sell in.

- Define FX conversion rules and approval workflows.

- Automate supplier and contractor payouts from the same platform.

- Connect reporting to accounting so reconciliation stays clean.

Sales growth lever

When you price and collect in local currency, customers feel more confident. You also reduce FX surprises that cause support issues and refunds. Better money movement can even improve margins by reducing avoidable conversion costs.

Watch outs

Multi-currency operations add complexity to accounting and controls. Define who can move funds and when. Also document the difference between “settled,” “available,” and “converted” balances for internal teams.

Quick start checklist

- List the countries and currencies that drive most revenue.

- Open accounts and connect them to your finance workflows.

- Build payout templates for common supplier and partner types.

- Test reconciliation with real transactions before scaling.

- Set internal approvals and monitoring rules for treasury.

18. Visa Direct

Instant payouts are becoming table stakes for marketplaces, gig platforms, and any business that needs to move money quickly to users. Visa Direct enables push-to-card payouts to eligible Visa cards, letting teams deliver near-real-time disbursements for earnings, refunds, claims, incentives, or partner payments—without forcing recipients to adopt a new wallet or app.

Payment trend

Instant payouts (push-to-card disbursements for marketplaces, gig platforms, refunds, and claims).

Best for

Platforms that need fast, card-based payouts at scale—especially marketplaces, on-demand/gig apps, fintechs, insurance, and businesses running high-volume disbursements or “instant cashout” features.

Key workflows to configure

- Design payout options (standard vs. instant) and decide where instant payouts fit: seller earnings, gig wages, refunds, claims, or promotions.

- Implement recipient onboarding with clear payout eligibility requirements and a low-friction way to capture/verify card credentials.

- Wire up payout status handling (success, pending, rejected/returned) so support and finance can resolve issues quickly.

- Build reconciliation around payout references, fees, and settlement reporting so accounting stays clean as volume grows.

Sales growth lever

Fast payouts reduce churn and increase repeat usage—users stick with platforms that pay quickly and predictably. An “instant payout” option can also become a revenue lever (where applicable) while improving user satisfaction and lowering “where’s my money?” support load.

Watch outs

Coverage, eligibility, and payout behavior can vary by region, issuer rules, and recipient card details. Plan for exceptions (rejections/returns), add sensible limits and risk controls, and make payout expectations clear in UI copy so customers don’t assume every payout is instant in every scenario.

Quick start checklist

- Pick the primary payout use case (earnings, refunds, claims, incentives) and define “instant vs. standard” rules.

- Design recipient onboarding and card capture flows with strong UX and clear expectations.

- Implement end-to-end status tracking and support playbooks for rejects/returns.

- Set risk controls (limits, velocity checks, monitoring) before scaling.

- Pilot with a small segment, validate payout success rates and reconciliation, then expand gradually.

19. Mastercard Send

Payouts now need to reach more endpoints with less complexity. Mastercard Send enables businesses to push funds through different delivery channels. It can help you support more recipient preferences while keeping your payout process consistent.

Payment trend

Flexible payout delivery to more endpoints with consistent payout operations.

Best for

Businesses that run global payout programs or need flexible delivery options for recipients.

Key workflows to configure

- Collect and validate recipient delivery details during onboarding.

- Build compliance and verification checkpoints for payouts.

- Integrate payout status reporting into your support workflow.

- Define exception handling for failed deliveries and returned funds.

Sales growth lever

Reliable payouts increase partner satisfaction. They also reduce churn for gig, creator, and marketplace supply. As you expand regions, a flexible payout rail can help you launch faster.

Watch outs

Coverage and behavior differ by region and recipient type. Avoid promising the same payout experience everywhere until you validate it. Also keep strong controls to prevent internal and external payout abuse.

Quick start checklist

- Map your payout use cases and recipient segments.

- Define the recipient data you must collect upfront.

- Build status visibility into your admin and support tools.

- Test exception and reversal cases carefully.

- Roll out region by region with clear metrics.

20. Tipalti

Payout operations are becoming part of brand experience. Partners expect smooth onboarding, clear tax workflows, and predictable payment timing. Tipalti can help you combine payee onboarding with payout automation, which can reduce manual work and prevent costly errors.

Payment trend

Payout ops as brand experience (payee onboarding + tax/compliance workflows + automation).

Best for

Marketplaces, networks, and SaaS businesses that pay many partners, suppliers, or contractors.

Key workflows to configure

- Create a payee onboarding portal with required compliance steps.

- Configure payment approvals and separation of duties.

- Offer multiple payout methods so payees can choose what fits them.

- Automate reconciliation and payout reporting for finance.

Sales growth lever

Faster onboarding helps you activate partners quicker. A smoother payout experience increases partner retention and reduces support load. That can improve supply quality, which often drives customer satisfaction and revenue.

Watch outs

Configuration can get complex if your payee types vary a lot. Start with a simple model, then expand. Also keep careful control over permissions and payout approval rules to reduce internal risk.

Quick start checklist

- Segment payees by country, payment method, and compliance needs.

- Define onboarding requirements and approval steps.

- Integrate your payee database and payout triggers.

- Test payout cycles end-to-end with a small cohort.

- Review reconciliation output with finance before scaling.

21. Bill.com

Business payments are moving away from manual processes. Teams want faster approvals, better visibility, and fewer paper-based steps. Bill.com supports this by automating accounts payable and receivable workflows and centralizing approvals and payments.

Payment trend

AP/AR automation replacing manual business payments (approvals, visibility, and fewer paper steps).

Best for

Finance teams that want to streamline vendor payments and invoice handling.

Key workflows to configure

- Set invoice capture and approval routing based on department rules.

- Standardize vendor records so payments go to the right destination.

- Connect your accounting system to keep books in sync.

- Define payment timing rules that match cash flow strategy.

Sales growth lever

Faster, more accurate payables reduce operational drag. That lets teams spend more time on growth activities instead of chasing approvals. Better cash visibility can also help you negotiate supplier terms and avoid late fees.

Watch outs

Automation depends on clean vendor data and clear approval ownership. If permissions are messy, teams may route around the system. Invest in training and internal controls from the start.

Quick start checklist

- Audit current payables workflow and bottlenecks.

- Import vendor list and clean duplicates.

- Set approval policies by spend category.

- Run a pilot with a small group of vendors.

- Validate accounting sync before full adoption.

22. Ramp

Spend management is converging with payments. Businesses want tighter controls, better visibility, and less manual reconciliation. Ramp enables its users to combine corporate cards, policy controls, and automated expense workflows that reduce finance overhead.

Payment trend

Spend management converging with payments (cards + controls + automated expense workflows).

Best for

Companies that want to control employee spend while reducing time spent on expense reporting and approvals.

Key workflows to configure

- Create spending policies by role, team, or vendor category.

- Issue cards with limits and approval requirements.

- Automate receipt capture and accounting coding rules.

- Review vendor spend patterns to catch waste early.

Sales growth lever

Better spend controls protect margins. They also free up team time by reducing expense admin. When finance runs smoothly, leadership can invest more energy in growth and customer experience.

Watch outs

Controls can feel restrictive if you roll them out without context. Communicate policies clearly. Also align accounting categories early so reporting stays consistent across the organization.

Quick start checklist

- Define your spend policy goals and pain points.

- Connect accounting and set category mappings.

- Onboard a pilot group of employees and vendors.

- Review policy exceptions and tune rules.

- Expand rollout after reporting looks clean.

23. Modern Treasury

Payments operations is becoming a competitive advantage. High-volume money movement needs clean reconciliation, clear status visibility, and fewer manual interventions. Modern Treasury helps teams orchestrate bank payments and reconcile them with internal systems.

Payment trend

Payments operations as a competitive advantage (bank payment orchestration + reconciliation + status visibility).

Best for

Businesses with complex money movement, multiple bank accounts, or high transaction volumes.

Key workflows to configure

- Connect banks and standardize payment initiation across accounts.

- Build a unified view of payment status and exceptions.

- Automate reconciliation to your ledger or accounting system.

- Handle returns and corrections with a repeatable workflow.

Sales growth lever

Cleaner operations reduce payment failures and support tickets. They also speed up cash application, which improves working capital visibility. When you can trust your money movement layer, you can launch new products faster.

Watch outs

Payments operations tooling needs strong internal data consistency. If you have messy identifiers or inconsistent customer records, you will feel friction. Start by cleaning your data model before you automate everything.

Quick start checklist

- Document all payment flows and bank accounts involved.

- Standardize identifiers for customers, invoices, and payments.

- Connect banks and test a limited payment flow first.

- Build reconciliation rules and validate outputs with finance.

- Expand to more rails after exceptions stay low.

24. Marqeta

Embedded finance remains a major trend because it turns payments into product features. Marqeta offers card issuing infrastructure that lets platforms launch branded card programs, spending controls, and real-time authorization logic that matches modern product needs.

Payment trend

Embedded finance via card issuing (branded cards, real-time authorization logic, productized spend controls).

Best for

Platforms and fintechs that want to launch branded cards, controlled spending programs, or embedded payments features.

Key workflows to configure

- Define your issuing program rules and spend controls.

- Implement real-time authorization decisions that match your product logic.

- Enable tokenized provisioning for wallet-based usage.

- Build dispute handling and customer support workflows for card issues.

Sales growth lever

Branded issuing programs can improve product stickiness. They can also open new revenue streams tied to spend volume. When customers use your card, they engage more with your ecosystem and services.

Watch outs

Issuing requires careful compliance, risk management, and operational maturity. You also need the right partners for program management and banking relationships. Do not rush the launch without a full support plan.

Quick start checklist

- Define target users and core card use cases.

- Map compliance, risk, and customer support responsibilities.

- Build authorization rules and test edge cases.

- Run a closed pilot with limited users and limits.

- Expand only after disputes and support are stable.

25. Galileo

Fintech infrastructure platforms keep enabling brands to launch banking-like experiences. Galileo is such a platform, consisting of APIs for payments, cards, and money movement features. It helps teams build modern financial products without starting from scratch.

Payment trend

Fintech infrastructure APIs enabling brands to ship banking-like payments and money movement features faster.

Best for

Fintechs and brands building wallets, banking features, or payment products that require scalable infrastructure.

Key workflows to configure

- Design account structures and ledger logic for your product.

- Integrate payment rails and card processing workflows.

- Set up dispute handling and customer support processes.

- Implement fraud controls and monitoring signals from day one.

Sales growth lever

Infrastructure that scales lets you launch new features faster. It also helps you reduce outages and friction that damage trust. When customers trust your money movement, they keep balances and spend more within your ecosystem.

Watch outs

Infrastructure does not remove regulatory responsibility. You still need clear compliance ownership, partner management, and operational controls. Plan for audits, support, and incident response early.

Quick start checklist

- Define the product scope and required rails.

- Map compliance and partner responsibilities clearly.

- Build sandbox integrations and test core flows.

- Document customer support for payment and card issues.

- Launch a controlled beta and iterate quickly.

26. Persona

Identity is becoming central to payments performance. Teams want to stop fraud while keeping good users moving. Persona supports this trend by helping businesses verify identity during onboarding and build risk-based workflows that adapt to user behavior.

Payment trend

Identity becoming central to payments performance (risk-based onboarding and verification).

Best for

Businesses that need stronger onboarding verification for compliance, fraud prevention, or trust and safety.

Key workflows to configure

- Design verification steps that match your risk tiers.

- Create a fallback manual review process for edge cases.

- Verify businesses and not just individuals when your model requires it.

- Log verification outcomes so risk teams can tune policies.

Sales growth lever

Smarter identity checks reduce fraud while keeping signup conversion healthy. When you approve more legitimate users, you increase revenue without increasing marketing spend. Trust also improves repeat usage and retention.

Watch outs

Identity checks can frustrate users if they feel random or invasive. Explain why you ask for information and keep steps minimal. Also watch for bias and false rejects that harm good customers.

Quick start checklist

- Segment users by risk and define verification requirements.

- Implement a clear, branded verification experience.

- Set up manual review for uncertain cases.

- Update privacy and consent disclosures.

- Monitor approval rates and fraud outcomes weekly.

27. Forter

Fraud prevention now needs to protect revenue without adding friction. Forter fits this payment trend by focusing on identity-based decisioning that can reduce false declines. The economics also push teams to act. LexisNexis reports a $3.00 total cost for each dollar lost to fraud, which highlights how much more is at stake than the stolen amount.

Payment trend

Fraud decisioning designed to protect revenue without adding friction (reducing false declines).

Best for

E-commerce and marketplaces that struggle with chargebacks, account abuse, or manual review overhead.

Key workflows to configure

- Connect order, customer, device, and payment data sources.

- Run decisions in shadow mode first to benchmark outcomes.

- Define escalation steps for borderline cases and high-value orders.

- Set feedback loops from chargebacks and refunds into policy tuning.

Sales growth lever

Approving more good orders increases revenue immediately. Reducing checkout friction also increases conversion. When risk decisions become smarter, your support and operations teams spend less time cleaning up issues.

Watch outs

Automation can hide problems if you do not monitor it closely. Keep clear ownership and a regular review cadence. Also align fraud policy with your brand promise so you do not punish loyal customers.

Quick start checklist

- Define what “good” and “bad” outcomes mean for your business.

- Connect data sources and validate event quality.

- Test decisions in shadow mode before enforcing them.

- Train support on fraud-related decline and review scenarios.

- Track false declines, chargebacks, and refund abuse trends.

28. Riskified

More merchants want predictable fraud outcomes and less manual review. Riskified supports this trend by offering risk decisioning and models that can reduce chargeback exposure. For teams that grow quickly, it can also provide structure around fraud operations.

Payment trend

Predictable fraud outcomes with less manual review (structured chargeback and risk operations).

Best for

High-volume e-commerce businesses that need to reduce fraud losses while keeping approval rates strong.

Key workflows to configure

- Integrate order screening into your checkout decision flow.

- Align refund and cancellation policies with fraud outcomes.

- Connect chargeback events so models learn from real disputes.

- Build reporting for approval rates and decision confidence over time.

Sales growth lever

Better fraud decisions mean more approved orders with less risk. That directly increases revenue, especially during peak demand. It also reduces the hidden cost of manual review teams and slow fulfillment holds.

Watch outs

Fraud tools work best when your internal policies stay consistent. If you change refund rules often, you can confuse both customers and your risk signals. Keep tight alignment between fraud, support, and operations.

Quick start checklist

- Audit chargeback drivers and top fraud patterns.

- Integrate screening and validate event data quality.

- Review early decisions manually to build confidence.

- Document policies for refunds, cancellations, and holds.

- Monitor approval rate, chargebacks, and customer complaints.

29. Sift

Account takeovers and abuse now affect payment outcomes as much as stolen cards. In this environment, Sift is a great choice, helping businesses detect risky behavior across signup, login, and transaction events. For many companies, protecting accounts is the first step to protecting revenue.

Payment trend

Account protection and abuse prevention (ATO, promo abuse, behavioral risk signals across the funnel).

Best for

Marketplaces, subscription services, and digital goods businesses that face account takeover, promo abuse, or payment fraud.

Key workflows to configure

- Track behavioral events across signup, login, and checkout.

- Set adaptive friction steps for suspicious activity.

- Monitor promo code usage patterns tied to identity signals.

- Feed confirmed fraud outcomes back into model tuning.

Sales growth lever

When you prevent account takeover, you protect your best customers and reduce churn. You also reduce support load from disputes and refunds. A safer ecosystem increases trust, which often improves conversion and retention.

Watch outs

Risk scoring needs ongoing tuning. If you add friction too aggressively, you can hurt legitimate customers. Also keep privacy compliance tight, especially when you collect behavioral signals.

Quick start checklist

- List your top abuse patterns and where they start in the funnel.

- Instrument key events with consistent identifiers.

- Launch risk scoring in monitor mode first.

- Introduce friction only where it reduces real losses.

- Review outcomes regularly with fraud and support teams.

30. Circle

Stablecoins keep moving closer to mainstream payment infrastructure. Circle supports this trend by providing tools and networks around USDC and programmable value transfer. The adoption signals keep growing as well. Circle reports USDC in circulation grew by more than 78% year-over-year, which shows how quickly “digital dollars” can scale when businesses find practical use cases.

Payment trend

Stablecoins and programmable money moving toward mainstream payment infrastructure (faster settlement and cross-border rails).

Best for

Global platforms exploring faster cross-border settlement, developer-led payment products, or stablecoin-based treasury workflows.

Key workflows to configure

- Define a stablecoin policy for treasury, custody, and permissions.

- Set compliance checks for counterparties and transfers.

- Build accounting and reconciliation workflows for onchain activity.

- Start with internal settlement or limited partner payouts before customer-wide rollout.

Sales growth lever

Stablecoin rails can reduce friction in cross-border settlement and payouts. Faster settlement can also enable new business models, like near-instant partner payouts. When you move value faster, you improve partner experience and unlock product flexibility.

Watch outs

Stablecoin operations require strong security practices and careful compliance work. Wallet security failures can become catastrophic incidents. Treat custody, access controls, and monitoring as core parts of the product.

Quick start checklist

- Align legal, compliance, finance, and engineering on the use case.

- Choose custody and security approach with clear ownership.

- Run a pilot with low-risk internal or partner flows.

- Define accounting treatment and reconciliation steps.

- Expand slowly with monitoring and incident response plans.

Leverage 1Byte’s strong cloud computing expertise to boost your business in a big way

1Byte provides complete domain registration services that include dedicated support staff, educated customer care, reasonable costs, as well as a domain price search tool.

Elevate your online security with 1Byte's SSL Service. Unparalleled protection, seamless integration, and peace of mind for your digital journey.

No matter the cloud server package you pick, you can rely on 1Byte for dependability, privacy, security, and a stress-free experience that is essential for successful businesses.

Choosing us as your shared hosting provider allows you to get excellent value for your money while enjoying the same level of quality and functionality as more expensive options.

Through highly flexible programs, 1Byte's cutting-edge cloud hosting gives great solutions to small and medium-sized businesses faster, more securely, and at reduced costs.

Stay ahead of the competition with 1Byte's innovative WordPress hosting services. Our feature-rich plans and unmatched reliability ensure your website stands out and delivers an unforgettable user experience.

As an official AWS Partner, one of our primary responsibilities is to assist businesses in modernizing their operations and make the most of their journeys to the cloud with AWS.

Conclusion

The biggest payment trends all point in the same direction: customers expect faster checkout, more ways to pay, and fewer failures—while businesses need tighter risk controls, cleaner reconciliation, and better payout experiences. Whether you’re adding digital wallets, enabling bank-connected flows, modernizing subscriptions, or rolling out instant disbursements, the “right” trend is the one that removes friction for your users without adding chaos for your ops team.

The most effective approach is to treat trends like a roadmap, not a checklist. Start with a quick audit of where you lose money or customers today (drop-offs, declines, disputes, payout delays), then prioritize one or two upgrades that directly move those outcomes. Implement with clear UX, strong monitoring, and solid fallbacks for edge cases, and roll changes out gradually so performance and risk stay predictable.

In the end, payment trends only matter when they’re operationalized. Pick the upgrades that fit your business model, ship them with measurable goals, and keep iterating—because the best “modern payments stack” is the one that continuously improves conversion, reliability, and trust over time.