- 1. Trade Ideas – AI-Powered Stock Scanner and Trader

- 2. TrendSpider – Technical Analysis Meets AI Automation

- 3. Tickeron – AI Robots and Pattern Recognition

- 4. StockHero – No-Code Bot Creation with Paper Trading

- 5. Kavout – AI Stock Rating and Paper Trading Platform

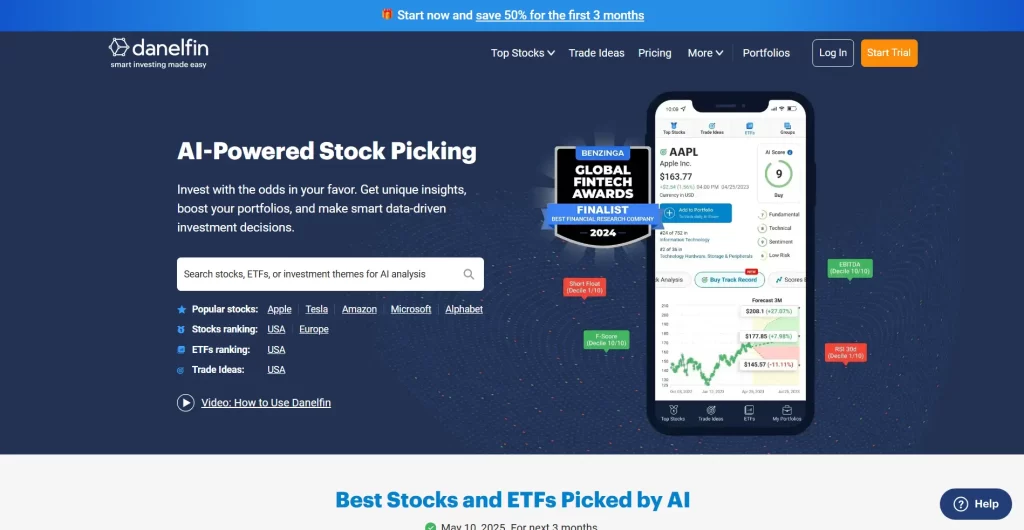

- 6. Danelfin – AI Stock Picking and Analytics Tool

- 7. AInvest – Personal AI Trading Assistant with Live Integration

- Conclusion

Artificial intelligence is revolutionizing the way people invest and trade. AI-powered algorithms can analyze market data at lightning speed, spotting patterns and opportunities that humans might miss. In fact, more than 90% of investment managers worldwide are already using or planning to use AI in their investment process. AI trading bots – software programs that use machine learning and automation to execute trades or provide signals – have surged in popularity as a result. The best ai trading bot can help both beginners and experienced traders make faster, data-driven decisions and even automate their strategies for hands-free trading.

Recent statistics show how prevalent AI has become in stock trading. A late-2024 survey found 61% of investment professionals use AI to assist with investments and trading. Even in hedge funds, AI-driven quantitative strategies made up over 40% of trading volume in 2024. Overall, algorithmic trading (much of it now AI-enhanced) accounts for a large majority of market volume. These numbers underscore why finding the best AI trading bot is on every savvy investor’s mind – the right bot can process vast data, run 24/7 without emotions, and potentially give you an edge in the market.

But not all AI trading bots are created equal. The top platforms offer a mix of features like live trading automation, paper trading or backtesting, user-friendly interfaces, and strong AI analytics. Below, we at 1Byte compare 7 of the best AI trading bots available today. We’ve included a blend of free and paid options, and highlighted tools suitable for both beginners and experienced traders. Each of these platforms can help you invest smarter by leveraging AI – let’s dive in.

1. Trade Ideas – AI-Powered Stock Scanner and Trader

Trade Ideas is an advanced AI-driven stock trading platform that has been around since 2003. It’s widely regarded as a leader in AI stock scanning and trade signals. Trade Ideas connects directly to stock exchanges and analyzes every market tick in real-time using AI algorithms. Its AI engine, nicknamed “Holly,” continuously monitors the market and generates trading ideas, complete with suggested entry and exit points.

One standout feature is the simulated trading mode for paper trading. Trade Ideas is suitable for all experience levels, as it offers a virtual trading room where beginners can practice without risk. Intermediate users can utilize pre-built AI strategies, while experts can customize their own algorithms. For live trading, Trade Ideas provides a module called Brokerage+ that lets you connect to brokers (like Interactive Brokers or E*TRADE) to automate the AI-driven trades in your actual account.

Key Features

- Real-time AI signals: The Holly AI scans thousands of stocks and ETFs intraday and provides high-probability entry and exit signals based on statistical models. It helps find opportunities in momentum stocks, breakouts, and more.

- Backtesting and OddsMaker: Trade Ideas includes a backtesting tool (“OddsMaker”) to test strategy performance on historical data. You can refine the AI strategies and immediately see how they would have done in past markets.

- Simulated trading: A built-in paper trading feature lets you practice strategies using virtual money. This is great for beginners to learn or for testing ideas safely.

- Visualization tools: Advanced chart visuals like Treemaps (market heat maps) and the unique Stock Races feature help users spot fast movers in a fun, intuitive way. You can also open multiple chart timeframes with Picture-in-Picture charts for better context.

- Customization and alerts: Users can customize scans or even create their own AI stock screens. Real-time price alerts and a market dashboard keep you on top of notable moves.

Trade Ideas is a premium platform – it offers a free limited version with delayed data, but for real-time AI trading you’ll need a subscription (plans start around $89 per month). It’s best suited for active stock traders who want a powerful AI assistant. The learning curve can be a bit steep due to the plethora of features. However, those who invest the time often find it invaluable for day trading and swing trading. Trade Ideas’ AI has been shown to identify profitable setups and manage risk in volatile intraday markets, making it a top choice for the best AI trading bot in the stock market realm.

2. TrendSpider – Technical Analysis Meets AI Automation

TrendSpider is a popular technical analysis platform that has integrated AI to help traders automate their strategies. Launched in 2018, it’s now used by over 15,000 traders worldwide. TrendSpider is known for its intelligent charting and scanning tools, and with the addition of its AI features, it has become even more powerful for both beginners and advanced users.

TrendSpider’s flagship AI capability is the AI Strategy Lab, which allows users to create, test, and deploy trading strategies without any coding. You can specify conditions (technical indicator signals, candlestick patterns, etc.), and the AI will help generate strategy variations and optimize them. These strategies can then be run through backtesting to see how they would have performed historically. With a few clicks, you can tweak parameters and let the AI suggest improvements, greatly simplifying what used to require programming knowledge.

Another notable feature is TrendSpider’s Trading Bots. Once you have an AI-generated (or manually created) strategy, you can turn it on as a bot that will automatically execute trades or other actions when its conditions are met. For example, a bot can be set to buy or sell when specific technical conditions align, or even send you alerts via email/Discord. This essentially gives you hands-free trading on any timeframe – the bot watches the market for you.

Key Features

- AI Strategy Lab: Build and refine trading strategies using machine learning suggestions, no coding needed. The AI can analyze which indicators or signals would have worked best together.

- Backtesting & optimization: Integrated backtesting lets you run your strategy on past data to see win rates, drawdowns, and more. You can iterate quickly to improve performance.

- Multi-asset support: TrendSpider supports stocks, ETFs, futures, forex, and cryptocurrencies in one platform. This is great for diversified traders – you can train an AI model on one market and apply it to others.

- Automated trading bots: Deploy fully automated bots that connect to broker APIs or third-party services to execute trades. The platform can also automate non-trade actions (like posting to a private chat) when conditions trigger.

- Smart charts & alerts: Apart from AI, TrendSpider offers automated trendline detection, dynamic price alerts, heatmaps, and many tools for technical chart analysis. It basically acts as a one-stop trading workstation.

TrendSpider is a paid platform (with free trials available). It’s relatively user-friendly, with lots of tutorials guiding new users through the features. Beginners can start by using pre-made strategy templates or scanning for trade ideas, while experienced traders benefit from deep customization. If you are into technical trading and want to save time, TrendSpider’s blend of machine learning and automation makes it one of the best AI trading tools to consider for smarter investing.

3. Tickeron – AI Robots and Pattern Recognition

Tickeron is an AI-driven trading platform that offers a suite of tools for stock and cryptocurrency traders. It stands out for its AI pattern recognition and a variety of AI “robots” that generate trading signals. Tickeron is accessible via web and is aimed at both retail traders and investors looking for algorithmic strategies without needing to code.

One of Tickeron’s core features is its library of AI Robots. These are essentially automated trading strategies that scan the market for opportunities. For instance, Tickeron’s AI Robots continuously scan selected stocks and ETFs (the user can choose a watchlist) every minute to find trading opportunities based on real-time chart patterns. The platform uses neural network models to identify classic patterns (like breakouts, head-and-shoulders, etc.) and will issue buy/sell suggestions when it spots a reliable pattern. Some AI Robots also run “trading rooms” where the AI executes a strategy in a simulated environment, which users can follow or copy.

Another notable aspect is AI Trend Forecasting. Tickeron’s AI analyzes historical price data to predict short-term trends for stocks or other assets, and it assigns a confidence level to each prediction. For example, it might say there’s an 80% confidence that stock XYZ will rise 5% in the next week based on similar past setups. Users can adjust the minimum confidence level they want to act on – a nice feature for risk management (more cautious traders might only heed signals above, say, 70% confidence).

Key Features

- Pattern search and signals: Tickeron’s AI can detect hundreds of technical patterns and anomalies. It provides real-time buy/sell signals when patterns complete, along with statistical probabilities for the expected outcome.

- AI trading bots (“Robots”): A variety of pre-built AI strategies (for swing trading, trend following, etc.) are available. They show track records, and you can subscribe to their signals. The AI Robots update positions in real-time, showing hypothetical profits and stop-loss levels for each trade.

- AI portfolios: For longer-term investors, Tickeron offers AI-managed portfolios and asset allocation suggestions. The AI can recommend portfolio adjustments based on market conditions.

- Backtesting and paper trading: You can backtest patterns and robot strategies on historical data to see how they would have performed. Tickeron also allows paper trading mode so you can simulate following AI signals without risking money.

- Education and transparency: The platform provides detailed analytics for each AI strategy (win rates, past trades) and educational resources to help users understand the AI’s logic. This is helpful for building trust in the bot’s recommendations.

Tickeron has both free and paid elements. Many AI-generated insights (like basic pattern recognitions or limited signals) can be accessed for free on the website. Premium subscriptions unlock full AI robot access, more frequent signals, and advanced features. The interface is quite intuitive, with dashboards for different AI tools. For beginners, Tickeron’s ready-made strategies and clear visuals (like charts showing each signal’s outcome) make it a friendly introduction to AI trading. Experienced traders can use Tickeron to supplement their own analysis or to quickly screen the market for setups. With features like adjustable confidence levels and real-time pattern scanning, Tickeron offers a versatile approach to AI-assisted tradingunite.aiunite.ai.

4. StockHero – No-Code Bot Creation with Paper Trading

Stock Hero is a cloud-based trading bot platform that emphasizes ease of use. It’s designed so that no programming knowledge is required – you can create, test, and deploy an AI trading bot in minutes through a visual interface. Stock Hero supports multiple asset classes, including stocks and cryptocurrencies, and it features a robust paper trading mode alongside live trading.

For beginners, one of the biggest draws of Stock Hero is its simulated paper exchange. Upon signing up, you can immediately build a strategy and run it on historical or real-time simulated data, risk-free, with virtual funds. This allows you to backtest and forward-test your bot easily. The platform provides various strategy templates (like mean reversion, momentum, etc.) which you can tweak via sliders and rules. Once you’re confident in a bot’s performance, you can deploy it live by connecting your brokerage or exchange account.

Stock Hero integrates with several major brokers and exchanges. It currently supports API connections to brokers such as TradeStation, Webull, Tradier, E*TRADE (beta), and even Robinhood for crypto trading. On the crypto side, it can connect to popular exchanges like Binance or Coinbase Pro. This means your Stock Hero bot can execute real trades on your behalf across different markets, all from one interface. If your broker isn’t supported, you can still use Stock Hero purely as a signal provider (manually executing the trades it recommends).

Key Features

- User-friendly bot builder: Creating a strategy is menu-driven. You set your buy/sell conditions based on technical indicators, price moves, or even TradingView alerts, all through a point-and-click interface. No coding or script writing is needed.

- Backtesting and multi-timeframe analysis: Stock Hero allows backtesting your strategy on up to 6 different time frames (e.g., 1 week, 1 month, 3 months, 6 months, 1 year) to see consistency of performance. It uses historical candlestick data from your chosen market to evaluate the strategy.

- Paper trading environment: The built-in simulator lets you paper trade with virtual money, which is great for testing. For example, you can run a demo bot on AAPL with $10,000 virtual funds to see how it performs before risking real money.

- Live automation via API: When ready, connect your brokerage API keys to let the bot trade live. Stock Hero’s cloud infrastructure ensures trades are executed quickly (reducing lag) once signals trigger.

- Bots Marketplace: This unique feature is a marketplace of pre-made bots created by other traders. Users can rent strategies from experienced traders if they don’t want to build one from scratch. It’s a form of social trading – you can browse performance of various bots and deploy them easily (some are free, others may charge a fee to copy).

Stock Hero offers a free tier to get started (often a free trial or limited-functionality plan), and affordable monthly plans (around $30 for basic, up to $100 for pro) for more active use. For newbies, Stock Hero’s step-by-step approach and risk-free testing make it an excellent way to dip a toe into AI trading bots. Meanwhile, advanced users appreciate the flexibility to run many bots concurrently and the ability to connect multiple trading accounts. In summary, Stock Hero provides automation for stock traders in a very accessible package – it’s like having a personal strategy factory where you can safely experiment and then deploy winning strategies to the live market with confidence.

5. Kavout – AI Stock Rating and Paper Trading Platform

Kavout is an AI-driven investment platform known for its stock ranking algorithms. At the heart of Kavout is an AI engine called “Kai”, which uses machine learning to analyze enormous amounts of market data and produce actionable insights. Kavout’s approach is slightly different from a traditional trading bot: rather than executing frequent trades, it scores and ranks stocks to highlight the most promising opportunities for investors. That said, it does incorporate features for both paper trading and live portfolio management, making it a useful tool for smarter investing decisions.

Kai, the AI, processes millions of data points on stocks – including financial filings, price quotes, news articles, blog posts, and even social media updates. By digesting both numeric data and textual sentiment, it forms a comprehensive view of each stock. The output is often a predictive ranking or score. For example, Kavout might give a certain stock a high rating if the AI determines it has strong upside potential based on patterns in the data. These AI-generated stock ratings (sometimes called K Scores) help investors quickly identify stocks that merit further research or immediate action.

A great feature for users is Kavout’s paper trading portfolio. The platform allows you to create a virtual portfolio and test out investment strategies before using real money. You can add stocks that the AI recommends into your paper portfolio and track how the strategy performs over time. This is valuable for validating the AI’s suggestions in real market conditions without risking capital. If satisfied, you can then transition to a live portfolio (Kavout can integrate with certain brokerage accounts or you can manually implement trades that the AI suggests).

Key Features

- “Kai” AI engine: Analyzes structured and unstructured data (prices, fundamentals, news, social sentiment) to generate a stock ranking model. It uses diverse AI techniques (classification, regression, etc.) to predict future performance.

- AI stock screener: You can filter stocks based on the AI’s criteria – for instance, find all stocks with a top 10% AI score, or those the AI flags as trending upward. This helps narrow down investment ideas quickly.

- Paper trading and backtesting: The paper trading portfolio feature lets you simulate investing according to the AI’s picks. You can backtest the AI’s strategy on historical periods, or run it forward in real-time on paper to see how it does.

- Portfolio analysis tools: Kavout provides tools to build and manage a real portfolio as well. It can suggest portfolio optimizations, measure your portfolio’s risk, and compare it against benchmarks using AI insights.

- Market analysis and calendar: The platform offers a market dashboard that highlights top-rated stocks and notable upcoming events (earnings, etc.). It helps you stay informed about why the AI favors certain stocks, with explanatory analytics.

Kavout caters to both institutional and retail traders. While advanced in its analytics, it also has an interface manageable for individual investors. Pricing isn’t prominently advertised but they have offerings from a free tier (or trial) up to paid plans (one source notes a researcher plan starting at $20/month). If you’re an investor who wants AI to do heavy data-lifting – scanning fundamentals, technicals, and sentiment – Kavout is a compelling option. It especially shines for those interested in medium-term investing or stock picking, as its AI can help identify winners and losers. The inclusion of paper trading means you can validate the AI’s picks yourself: notably, Kavout’s AI was reported to accurately rank stocks such that the highest-rated outperformed the market by a significant margin in backtesting. This track record gives confidence in using Kavout as an AI investing assistant.

6. Danelfin – AI Stock Picking and Analytics Tool

Danelfin is an AI-powered stock analysis platform designed to help investors find the best stocks to buy (and know which to avoid). Rather than executing trades automatically, Danelfin functions as an AI stock picker and advisor. It assigns each stock an “AI Score” from 1 to 10, indicating the probability of that stock outperforming the market in the next 3 months. This simple scoring system is very user-friendly – even a beginner can glance at the score and gauge a stock’s short-term outlook according to the AI.

Under the hood, Danelfin’s AI analyzes 10,000+ data points per stock per day, covering technical indicators, fundamental metrics, analyst ratings, news sentiment, and more. It uses machine learning models to find patterns that historically led to a stock beating the market. A score of 10 means the AI is very confident the stock will outperform (based on learned patterns), whereas a score of 1 means it expects underperformance. This gives traders a quick way to screen opportunities. For example, you could use Danelfin to list all stocks with AI Score 9 or 10 and then do further research on those.

Danelfin backs up its scoring with impressive backtested results. According to the platform, stocks with the highest AI Score (10/10) significantly outperformed the market on average, while those with the lowest scores lagged far behind. In fact, an AI-driven “best stocks” strategy built on Danelfin’s scores returned +263% from 2017 to mid-2024, compared to +189% for the S&P 500 in the same period. This highlights the potential value of AI in stock selection when used properly.

Key Features

- AI Score and rankings: Every US-listed stock gets a daily updated score 1-10. You can see rankings of top-rated stocks and filter by region or sector. It’s a quick way to find promising candidates.

- Detailed analysis pages: For each stock, Danelfin provides a breakdown of why the AI likes or dislikes it. This includes key indicators influencing the score, recent news sentiment, and technical trends. It often flags specific strengths or risks identified by AI.

- Strategy and alerts: Users can create a strategy (for example, “buy stocks when they reach AI Score 9 and sell when they drop to 7”) and backtest it. You can also set up alerts for score changes – e.g., get notified if a stock’s AI Score jumps high one day (which might signal a new opportunity).

- Integration & portfolio tracking: Danelfin allows you to track your own portfolio’s AI Scores. This can help in deciding when to take profits or cut losses – e.g., if a stock in your portfolio sees its AI score fall sharply, that might warn of deteriorating outlook. It doesn’t directly trade for you, but it can integrate or be used alongside broker platforms for informed decision-making.

- Accessibility: The platform is web-based with a straightforward interface, including charts and visuals to illustrate performance vs. the market, AI win-rate percentages, etc. There are educational resources explaining AI concepts in plain language.

Danelfin operates on a freemium model – some basic features or a trial of AI scores may be free, while full access (including unlimited stock scores, in-depth analytics, and advanced strategies) comes with a subscription. It appeals to both novice investors (because the scores simplify analysis) and to experienced traders (who can incorporate the AI signals into their strategies). It’s important to remember that Danelfin’s outputs are probabilities, not guarantees; however, the tool is extremely useful as a second opinion or idea generator. By highlighting stocks that AI models find attractive, Danelfin can save investors hours of research and potentially boost returns with its data-driven approach. It’s like having a tireless analyst by your side that crunches numbers on thousands of stocks daily to point you toward the best opportunities.

7. AInvest – Personal AI Trading Assistant with Live Integration

AInvest is a newer entrant that acts as a comprehensive AI investing assistant. Available as a web and mobile app, AInvest’s aim is to bring AI-driven portfolio management and trading insights to everyday users. At the center of AInvest is its AI assistant named “Aime”, which you can think of as a robo-advisor and trading coach in one. Aime chats with users (much like a chatbot) to answer financial questions, provide real-time market insights, and even give personalized stock recommendations.

A key differentiator of AInvest is its emphasis on syncing with your actual investment accounts. You can connect AInvest to brokers like Robinhood, Charles Schwab, or Webull. By doing so, the AI can analyze your current portfolio, track your holdings’ performance, and tailor its advice to your situation. For example, Aime might notice your portfolio is heavy in tech stocks and suggest diversification, or it could alert you to news that specifically affects one of your holdings. The integration means AInvest isn’t just giving generic tips – it’s looking at your investments and market conditions in tandem.

For trading ideas, AInvest provides real-time signals and personalized recommendations. Its AI scans breaking news, social media, and market data to surface opportunities. If Aime spots a bullish pattern or a piece of news expected to move a stock you follow, it will notify you and even say something like, “Stock XYZ might be a good buy now because it got an upgrade from analysts and our models predict a 10% upside.” Essentially, it’s like having an AI co-pilot for making trading decisions, complete with explanations.

Key Features

- AI-powered financial assistant (Aime): You can interact via chat or voice to ask things like “How is my portfolio doing today?” or “Find me promising renewable energy stocks.” Aime will respond with analysis or suggestions, leveraging AI and vast data.

- Portfolio analysis and optimization: AInvest continuously analyzes your linked portfolios. It provides insights such as risk level, diversification, recent performance vs. market, and will suggest trades (buy/sell) or rebalances to improve your returns or reduce risk.

- Live trading signals: Through AInvest, you get real-time trade ideas. This could be day-trading signals, swing trade opportunities, or long-term investment picks. Each suggestion comes with a rationale (e.g., technical indicator breakouts, unusual volume, positive earnings surprise, etc.).

- News and sentiment tracking: The AI keeps an eye on news wires and social media. It will alert you to important news affecting your watchlist or portfolio. It also uses sentiment analysis to gauge market mood and possibly warn you if sentiment turns sharply negative on a stock you own.

- Brokerage integration: You can execute trades through the AInvest app thanks to its integration with broker APIs. This means when you agree with Aime’s suggestion, you can quickly place the order. It essentially can function as a trading platform powered by AI insights.

AInvest typically offers a subscription model (with a promotional first-month rate, e.g. $9.99, as noted in one source). There might not be a free trial beyond maybe a limited demo, but the pricing is positioned to be affordable relative to the value of advice it provides. This tool is especially suitable for beginner to intermediate investors who want guidance. It feels a bit like having a personal financial advisor or mentor available 24/7, but driven by AI. Advanced traders might use it to supplement their own analysis or to get quick answers (instead of scouring news and doing manual research). As AI continues to get smarter, platforms like AInvest showcase how an AI trading bot can also be an advisor – not just automating trades, but educating and supporting the investor’s decision-making process. It’s a modern way to invest smarter, with AI bridging the gap between raw data and actionable investment steps.

Leverage 1Byte’s strong cloud computing expertise to boost your business in a big way

1Byte provides complete domain registration services that include dedicated support staff, educated customer care, reasonable costs, as well as a domain price search tool.

Elevate your online security with 1Byte's SSL Service. Unparalleled protection, seamless integration, and peace of mind for your digital journey.

No matter the cloud server package you pick, you can rely on 1Byte for dependability, privacy, security, and a stress-free experience that is essential for successful businesses.

Choosing us as your shared hosting provider allows you to get excellent value for your money while enjoying the same level of quality and functionality as more expensive options.

Through highly flexible programs, 1Byte's cutting-edge cloud hosting gives great solutions to small and medium-sized businesses faster, more securely, and at reduced costs.

Stay ahead of the competition with 1Byte's innovative WordPress hosting services. Our feature-rich plans and unmatched reliability ensure your website stands out and delivers an unforgettable user experience.

As an official AWS Partner, one of our primary responsibilities is to assist businesses in modernizing their operations and make the most of their journeys to the cloud with AWS.

Conclusion

AI trading bots are transforming how people approach investing. They can sift through huge datasets in seconds, eliminate emotional bias, and execute disciplined strategies around the clock. The seven tools discussed – from advanced platforms like Trade Ideas to accessible assistants like AInvest – demonstrate the range of options available. The “best” AI trading bot for you will depend on your goals and experience level:

- If you’re a day trader or very active investor, a feature-rich platform such as Trade Ideas or TrendSpider could amplify your edge with real-time AI signals and automation.

- If you’re newer or prefer a guided experience, something like Stock Hero or AInvest provides hand-holding and easy setup. These let you learn and benefit from AI without needing a quant background.

- For those primarily interested in improving stock picks and strategy planning, AI advisory tools like Kavout or Danelfin can supercharge your research process. They act as an AI analyst giving you suggestions, which you can then trade manually or semi-automatically.

- And if you want pre-built strategies or pattern signals to supplement your own trading, Tickeron offers a rich library of AI insights that you can dip into as needed.

One thing to remember: while AI bots can be incredibly powerful, they are not magic money machines. Markets can always throw curveballs that even the smartest algorithm didn’t anticipate. Risk management and human oversight are still important. Many experts suggest using AI as a complement to, not a replacement for, your judgment. In practice, that means monitor your bot, understand its strategy, and be ready to intervene or adjust if conditions change.

In summary, AI trading bots are here to stay – they are already helping investors large and small make smarter investing decisions every day. By choosing one of the best AI trading bot platforms above that aligns with your needs, you can harness this technology to potentially improve your trading performance. Start with paper trading or a trial, get comfortable with the tool, and then gradually let the AI shoulder more of the workload. With the right balance of automation and human touch, AI trading bots can be a game-changer in your investing journey.